The big four Chinese cloud companies are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud. They collectively commanded 81% of the market share in China. Alibaba Cloud is the clear leader with a 45% share.

According to ReportLinker, the global market for Cloud Computing Services is estimated to grow at a CAGR of 17% over the period 2020-2027. Other reports have also suggested a CAGR above 10%.

In the same report, cloud services in China is forecast to grow even faster at 22.1% per year. There’s a lot of tailwind to the cloud business. The best news is…you can easily invest because most of them are listed companies (except Huawei, which is a private company):

- Alibaba Cloud -> Alibaba (SEHK:9988)

- Tencent Cloud -> Tencent (SEHK:700)

- Baidu AI Cloud -> Baidu (NASDAQ:BIDU)

Wondering “How to invest in Alibaba and Tencent?” Read our China Investing Guide.

The only downside is that you have to own other parts of the businesses and not just the cloud segment. All three companies have diverse businesses and cloud isn’t the majority revenue driver for them.

In fact, of the 3 listed companies, only Alibaba has a dedicated revenue reporting segment for its cloud business. It did well, jumping 62% from FY2019 and contributed about 8% of the total revenue in FY2020. Compared to just 3% of the revenue in FY2016, we can see that the cloud business is of an increasing importance to Alibaba.

I think China is still in the nascent stage of cloud services and there’s a lot of room to grow. Eventually, the revenue will be significant enough for Tencent and Baidu to dedicate a revenue reporting segment for it.

International cloud competitors

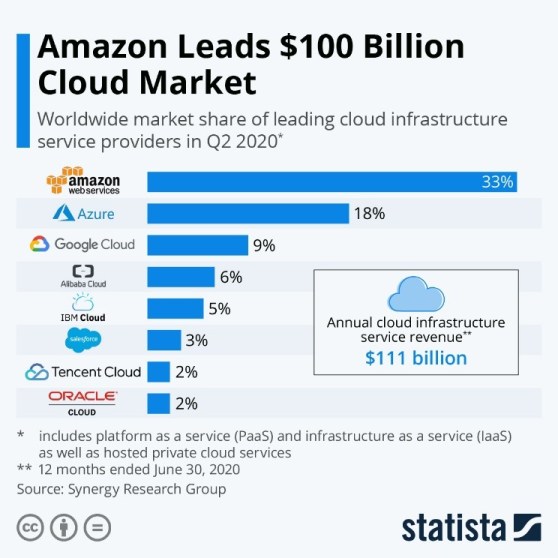

Amazon was the first company to effectively commercialise cloud services (Amazon Web Services or AWS) to the mass market. Its early mover advantage translated to a leading global market share of 33%, ahead of Microsoft Azure, Google Cloud and Alibaba Cloud.

The Chinese cloud players definitely harbour global ambition, but it ain’t going to be easy.

AWS’ first mover advantage isn’t the main problem in the Chinese’s fight for market share. The major issue is the bipolar situation that the world is in right now – US vs China.

Both countries have their big tech companies and each company wants to sell their services to everyone else. US is selling the narrative that China cannot be trusted and it is winning more mindshare because media outlets in the west are a lot more influential than those from China. Take Singapore as an example, it is more likely you come across a piece of news from Bloomberg than China Daily during your information routine.

Thus, I believe the mistrust of Chinese companies exist and this would be disadvantageous for the Chinese cloud companies. Why would one take the risk to put sensitive data on a cloud provider when he doesn’t trust it in the first place – you wouldn’t share a secret to someone you don’t trust right?

Hence, I think AWS, Microsoft Azure and Google Cloud will continue to dominate the worldwide cloud market share.

But the Chinese market is going to be huge enough

What goes around, comes around.

While the US big tech have the advantage globally, they have little to no chance in winning market share within China.

China is a closed market and Chinese enterprises are often protected as a result. This is good news for the big four Chinese cloud companies as they can expand without the threat from foreign players.

AWS generated over US$30 billion revenue a year while the entire China cloud market revenue was over US$10 billion. ReportLinker expected China cloud market to reach US$222.5 billion in 2027. That’s about 20x bigger than today!

That said, consulting firm Bain & Company, noted that Chinese companies spent less on IT compared to the developed countries. Not only that, Chinese companies had a higher proportion of their IT expenditure on hardware.

This could mean that the Chinese companies may experience the sunk cost effect – why go on to the cloud when I have spent on our own servers?

We have no visibility on how the consumer behaviour evolution would pan out. It could be true that the spending on cloud is going to slow down because of this sunk cost effect or it could go the other way – the Chinese companies realised they are missing out on a more efficient and effective cloud services in serving their customers that they had to get onboard eventually.

I believe the latter is more likely as technology advancement is rapidly changing the competitive landscape.

Conclusion

Cloud is the future and is expected to grow at a fast pace of 17% annual growth rate until 2027. China is forecast to grow even faster at 22% per year and a market size that is 20x bigger than today.

We have identified that while it is difficult for Chinese cloud companies to compete internationally because of the air of mistrust, the China market is huge enough for the big four Chinese cloud companies to gain handsomely from. Foreign cloud companies would find it difficult to enter the Chinese market because of the protectionist culture in China.

Alibaba Cloud, Tencent Cloud, Huawei Cloud and Baidu AI Cloud captured 81% of the Chinese cloud market and Alibaba took up 45% by itself.

3 of them are listed companies but only Alibaba Cloud has significant cloud revenue to report – about 8% of its FY20 revenue came from the cloud business. Due to the diverse businesses of these 3 companies, it is difficult to get a pure Chinese cloud exposure with your investment. If you can accept this, Alibaba would offer you the closest bet on the China cloud market.