Recently, a famous retailer of Apple products in Singapore was hot on the news. Jon covered the generics about the project in this post.

It was the first time, a subsidiary of a listed company has raised money through crowdfunding in Singapore.

I think it is important to know the actual entity that is borrowing the funds. The Listed Company is not borrowing, but one of her Subsidiaries is:

The loan of S$1m, at an annualised interest rate of 13.5%, was raised within 48 hours. This shows the credibility of a listed company’s backing, and how yield hungry Singapore investors can be.

Despite that, the act raised many eyebrows among investors – why is EpiCentre raising money through crowdfunding?

I don’t know the answer but I want to lay out the possible reasons in this article.

Possible Reason #1 – Having Some Issues With The Banks

Borrowing from banks is usually the first avenue for business who needs funds. The interest charged by the banks should be lower than on a crowdfunding platform. It is of no surprise that some observers may suspect something going was on between EpiCentre Pte Ltd and the banks.

We should gather some information from the annual report of her parent, EpiCentre Holdings Ltd.

Note: The finances of the subsidiaries are consolidated into the report of the Listed Entity, and hence, we can only approximate the health of EpiCentre Pte Ltd with the analysis of the entire Group.

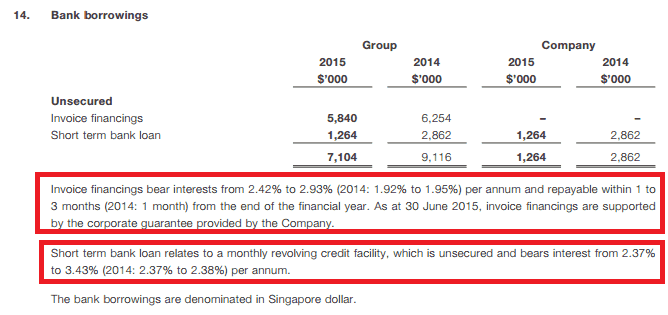

The Group has about $7.1m borrowings in 2015, which was pared down from $9.1m in 2014. Most of the borrowings are invoice financing, which means the Group can borrow money within the amount of sales achieved.

Most importantly, the bank interest rates are ranging from 2.37% to 3.43%, which are very low compared to the 13.5% rates promised to crowdfunders.

Why would the Group choose to pay a higher interests?

Is there really an unspoken issue with the banks?

Shrugged.

Possible Reason #2 – Exploring A New Source of Funding

Maybe there were no issues with the banks and the Group just wanted to test a new source of funding.

There were talks about credit tightening in the near future and business owners might want to establish multiple sources of funding in case borrowing gets tougher.

Crowdfunding is a promising alternative source and why not give it a try.

Lawrence Yong was probed by The Edge, but he did not give us the real reason as I hoped. He merely made a general statement, “banks sometimes adjust their credit portfolio to adapt to changes in the market. If and when tightened, this could affect companies receiving loans.”

This echoed the possible reason #2.

Also, the Group launched the third tranche of S$500k loan and was said to raise up to S$2m. This can also be an indication that they are testing the amount they could raise. Otherwise, why not raise S$2m at once?

Possible Reason #3 – Publicity Stunt

Being the first makes the news.

The first listed company to raise money through crowdfunding in Singapore means free publicity on many channels. Instead of paying advertisements and PR agencies, this could be a much more effective and cheaper avenue to get attention.

It may sell more iPhones and iPad Pros to come. Many crowdfunders may choose EpiCentre to get their Apple fix rather than other retailers.

Since I crowdfund the project, might as well buy from them? No?

On a side note, as an update to non-Apple fans, a smaller iPhone SE and iPad Pro were launched on 21 Mar 2016.

Conclusion

The management has declined to comment and the question why EpiCentre choose to crowdfund remains a mystery.

I think it is better to keep it this way as the incident seems more positive than negative.

The most scary possible reason is number 1. The other two reasons are okay. If the banks saw some risks in the Group and are not willing to lend, maybe it is better to err on the safe side.

If EpiCentre’s purpose was to create more awareness, and I have done you a favour with this article, you are welcome.

For more arguments for and against crowdfunding this project, see SGYI and Let’s Crowd Smarter.