The AI boom and tailwind remain as strong as ever.

While the first wave of AI was led by the Magnificent Seven, other companies now seem to be joining the cohort. The likes of Advanced Micro Devices Inc (NASDAQ: AMD), Intel Corp (NASDAQ: INTC) and Oracle Corp (NASDAQ: ORCL) proved that the second AI catalysts can upstage the incumbent outperformers.

To put things into perspective, all 3 stocks – AMD, INTC and ORCL have achieved YTD returns of more than +50%, with AMD close to hitting +100%.

While NVIDIA Corp (NASDAQ: NVDA) has still achieved a respectable +32% YTD, it pales in comparison, even when compared to INTC.

The AI tailwind is just starting and benefiting other companies. We have seen the second cohort of companies benefiting from it. The third tailwind is just around the corner, and these five companies could be next.

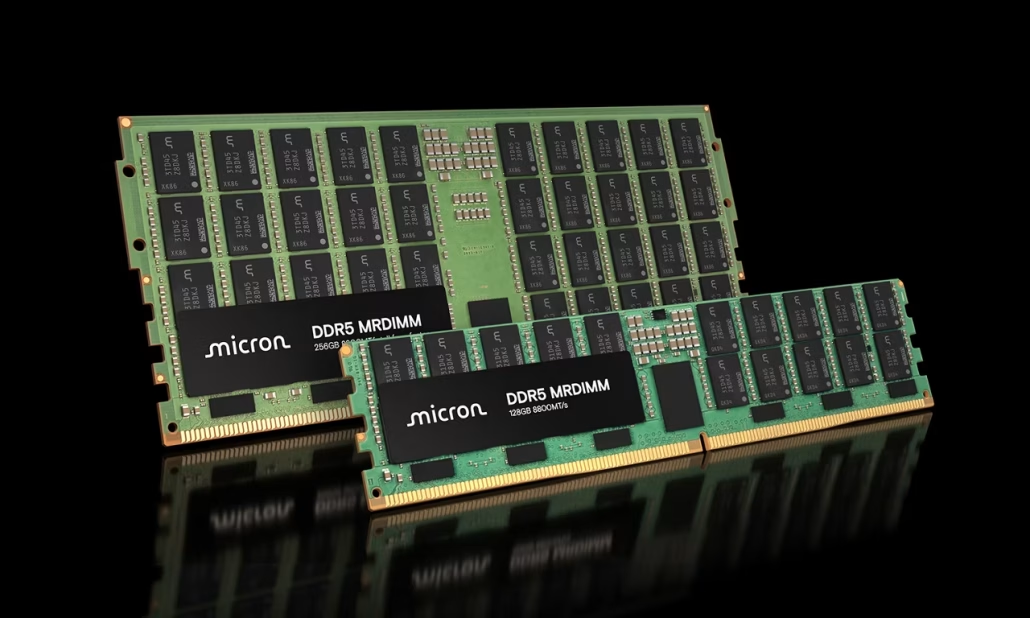

1. Micron Technology, Inc. (NASDAQ: MU)

Micron is a leading U.S.-based memory and storage solutions provider specializing in DRAM, NAND, and NOR memory products. It is at the forefront of supplying memory for AI data centers and compute-intensive applications.

In fiscal 2025, Micron reported record-breaking results driven by AI demand, generating US$ 37.38 billion in revenue, a +49% increase from the previous year, with GAAP net income soaring to US$ 8.54 billion. The company’s cloud and data centre memory business units posted robust growth with gross margins exceeding 50%, highlighting their strategic positioning as a key AI technology enabler.

The strong financial health is supported by significant operating cash flows and capital expenditure investments totalling US$ 15.9 billion in 2025, ensuring technological competitiveness. Micron’s momentum in AI markets stems from its advanced memory portfolio critical for AI model training and inference workloads.

Despite strong growth, Micron faces risks from cyclical memory market volatility, supply chain constraints, and increasing competition globally. Also, rapid technological shifts in AI hardware may challenge its current portfolio unless continuous innovation is sustained.

2. SanDisk Corp (NASDAQ: SNDK)

SanDisk, recently spun off from Western Digital in early 2025, focuses on flash storage solutions including memory cards, USB flash drives, and other solid-state storage products. It has a legacy of innovation in flash memory that supports high-speed AI data processing and edge computing demands. The company is positioned to capitalise on the growing need for fast, reliable storage in AI applications.

Financially, SanDisk has resumed independent operations with a fresh setup focused on expanding its footprint in AI-centric storage markets. It benefits from established customer bases and steady technological advancements in NAND flash.

SanDisk’s challenges and risks stems from the intense competition in the flash storage sector, pricing pressure, and reliance on Western Digital’s market transitions. However, the company could navigate the evolving AI storage requirements quickly to create and improve relevance.

3. Western Digital Corporation (NASDAQ: WDC)

Western Digital remains a dominant player in traditional and cloud storage hardware, with a strategic pivot towards AI-driven storage solutions. In fiscal 2025, Western Digital achieved US$ 9.52 billion in revenue, growing +51% year-over-year, signalling strong market demand. Its cloud segment, critical for AI infrastructure, represented a significant portion of this growth.

Western Digital’s dual focus on hard disk drives and solid-state solutions provides diversified revenue sources well-suited to AI data storage and management needs.

The company is still at risk of being a legacy storage business, although pivoting to AI-optimized systems amid fierce competition. Supply chain disruptions and technological obsolescence remain risks that could temper long-term growth.

4. CoreWeave Inc (NASDAQ: CRWV)

CoreWeave is a rapidly growing AI cloud computing company specialising in providing on-demand GPU infrastructure tailored explicitly for AI workloads. CoreWeave’s cloud platform supports engineering and deploying large AI models at scale, boasting more than 40,000 NVIDIA GPUs powering its services. It might not be the pioneer of GPUaaS, but it certainly is the first mover in pioneering NVIDIA’s superior chips as a service.

Its agility and specialization make it a prime candidate as an AI infrastructure provider. CoreWeave recently announced partnerships with several chip makers and cloud providers to expand AI cloud service delivery, highlighting vigorous business momentum in 2025.

Although its share price have risen by more than +200% as of writing, it is a smaller and newer enterprise compared to hardware giants, CoreWeave faces competition from established cloud players like AWS, Google Cloud, and Microsoft Azure, whom are developing chips to beat NVIDIA’s flagship chips. Should a market consolidation happens, its heavy technological dependency on NVIDIA hardware could pose challenge rather than an edge.

5. Nebius Group NV (NASDAQ: NBIS)

Nebius, based in Amsterdam, is an emerging AI infrastructure platform provider focusing on efficient model building, tuning, and execution on NVIDIA GPUs. The company combines AI-specific software and hardware infrastructure to cater to AI explorers and enterprises aiming to scale AI projects quickly and efficiently.

Nebius also offers educational initiatives through Nebius Academy to support broader AI technology adoption.

Nebius operates in a highly competitive, fast-evolving environment with pressure from global cloud AI providers. Its growth relies heavily on continuous innovation, scaling capacity, and client acquisition. Similar to CoreWeave, due to their niche offerings, the stock is also up +220% YTD.

Verdict

Just like the initial AI run that benefited stocks with track records and incumbents with the likes of SoundHound AI Inc (NASDAQ: SOUND) and Super Micro Computer Inc (NASDAQ: SMCI), I infer that there will be a mix of old and new blood that would benefit as AI slowly makes itself more relevant in our lives.

However, some of these companies are already priced for perfection, while some are still undervalued. The riskier ones may still rally more, but they also come with bigger risks. The stable ones might not be a one-hit wonder, but if pivot rightly, could be a great long-term hold.

There is no right or wrong in opting for a stable or a higher risk hyper growth – the risk tolerance lies with each investor. Those who missed out of NVIDIA would opt for CRWV or NBIS to play catch up, while those who are looking for stability would have their preferences skew towards MU, SNDK and WDC.

Which company looks exciting and is priced at the right value for you?

Join our Telegram for more insights: https://t.me/realDrWealth