As I approach the big 30, I see more and more of my friends’ baby pictures on their social networking sites. Some of them are expecting their first child while others are already at number two or three.

They may be worried about the expenses after having a new born baby, but at the same time they are also worry about unexpected events during the pregnancy period such as complications or congenital illness of the new born.

Recently one of my friends approach me to ask about maternity insurance. I will share the outcome of my analysis here.

What is Maternity insurance?

Maternity insurance is a term insurance that can be bought during the pregnancy period. Depending on the plan, expectant mothers between the 13th and 36th week of pregnancy are eligible to apply for the plan.

The main purpose of the plan is to cover for pregnancy complications and congenital illness for the new born baby. Example of pregnancy complication and congenital illness are as below:

In the event that the mother is diagnosed with any of the pregnancy complication or if the child is subsequently diagnosed with any of the congenital illnesses, a cash lump sum will be paid out to the policy holder.

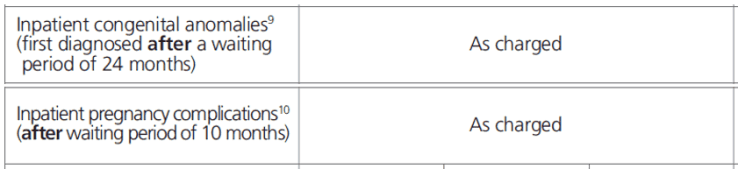

Besides that, maternity insurance also provide hospital care benefits that payout cash as a result of hospitalisation during the pregnancy and delivery period. The following are the coverage for hospital care benefit:

What to look out for in a Maternity Insurance?

Generally, most of the maternity insurance comes with a bundle package. Which means that other than the maternity insurance, you are required to purchase another insurance plan.

Currently, only NTUC and Great Eastern provide standalone maternity insurance. AXA is bundling their life insurance, endowment plan or Investment linked policy together with the maternity coverage. Prudential and AIA are bundling their packages with Investment linked policies.

Other than that, you should also look out for the number of coverage conditions and the coverage details such as policy years and the payout structure. Below is the summary of comparison for all the maternity insurance in Singapore.

Best Maternity Insurance In Singapore

Do take note that the comparison is meant to be taken as a summary only. You should check with your advisor for a more detailed comparison. There are also other health insurance plans that provide coverage for maternity, but they are not taken into consideration here as they also provide coverage for outpatient treatment, accident or medical reimbursement.

Maternity Insurance – To Buy or Not to Buy?

I am not a big fan of Investment linked policies (ILP). When it comes to insurance, I think we should not lump it together with investment. In the current market, there are many ways that we can invest our money with a much lower cost of investment than what insurance companies are offering. In that vein, I will not be proposing ILP Maternity Plans.

For plans that are bundled with endowment or life insurance, it really depends on the individual. If you are planning to get a life insurance or endowment for your child, then you can consider. Otherwise, a standalone plan is the best option.

However, do take note that all of these maternity insurance plans do not cover hospitalisation expenses. The maternity insurance plan only provides lump sum payout as cash. I find that the coverage is quite low as compared to the premium you are paying.

In addition, integrated shield plan in Singapore do provide some coverage for pregnancy complications and cover all hospitalisation expenses. You can read more about integrated shield plan here.

Although the coverage from Integrated shield plan (ISP) for pregnancy complication and congenital anomalies is not as complete as maternity insurance, all the hospitalisation expenses is fully covered under ISP. That should be sufficient for most cases.

Hi, for sharing

“Although the coverage from Integrated shield plan (ISP) for pregnancy complication and congenital anomalies is not as complete as maternity insurance, all the hospitalisation expenses is fully covered under ISP. That should be sufficient for most cases.”

For the delivery, the hospital expenses will actually be excluded (unless it is within the small list of complications stated under the IP for reimbursement). Hence, the use of the maternity insurance is to provide cash compensation for the conditions covered.

The congenital anomalies part is an exclusion for reimbursement unlike the benefits in maternity insurance which is a compensation..

Hi there, thanks for sharing your views on the maternity insurance, I am an Income agent, and just want to point out on one thing that Income’s Maternity360 sum assured is min $5,000 and up to $10,000, not just $5,000 as what was pointed out in the table.

After reading your article, I’m compelling to share your points on this topic. You have done a very good job. I agree with much of this information.