Even before his death in 1976, Graham highly recommended the strategy for small investors,

“………I consider it a foolproof method of systematic investment–once again, not on the basis of individual results but in terms of the expected group outcome.”

Benjamin Graham

But what exactly did Graham mean by “in terms of the expected group outcome“?

As it turns out, a lot… and this is also the key to how a net net stock strategy can protect you against loss over the course of your life. Let’s get started.

First, Great Profits

Net Net Stock portfolios perform well. Multiple studies across time support this.

In fact, studies consistently peg the strategy’s performance at roughly 15% above the overall market’s return. Since the market on average has returned 10% per year, compounded, that amounts to a 25% average annual return.

Depending on the strategy you use, your performance can even be higher. Greenblatt was able to decimate the market by over 40% per year before tax & commission in his study, How the Small Investor Can Beat the Market.

And even in Warren Buffett’s 2014 Berkshire Hathaway letter, Buffett himself reminisced about the exceptional returns he made using the strategy,

“My cigar-butt strategy worked very well while I was managing small sums. Indeed, the many dozens of free puffs I obtained in the 1950s made that decade by far the best of my life for both relative and absolute investment performance.

Warren Buffett 2014 letter to shareholders

………Most of my gains in those early years …came from investments in mediocre companies that traded at bargain prices. Ben Graham had taught me that technique, and it worked.” (p. 26)

So the returns are not in doubt, so long as you have the temperament to stick to the strategy.

If you do, and you’re investing small sums, then you can expect to nail down a CAGR of 25%+ over the course of your life.

Safety of Principal

But what about your downside?

As I mentioned, Graham looked at an investment as one that guaranteed safety of principal.

How can you protect your principal given how terrible these companies look and the fact that not every company in your portfolio will workout?

The answer is diversification.

When Graham suggested that net nets met his standard for investment, he wasn’t talking about a single stock — he was talking about a basket of net nets.

Diversification can practically neutralise the risk of owning just one net net, and it was really the returns of the group that Graham was aiming for. This is what he meant by “expected group outcome.”

So, while an individual net net may or may not work out, given that net nets have a high probability of rising back up to NCAV on average, diversification would mean that your portfolio was protected on the whole and should show good returns.

I also mentioned that you can’t just diversify in terms of the number of stocks you buy, you have to invest over a number of years as well to ensure good results from the strategy. Miss either of those and your returns fall apart.

By holding a fully stocked portfolio of net nets over the long term, the profit you’ll make during the good years will more than make up for any paper losses you’ll suffer during a bear market. This concept is critically important.

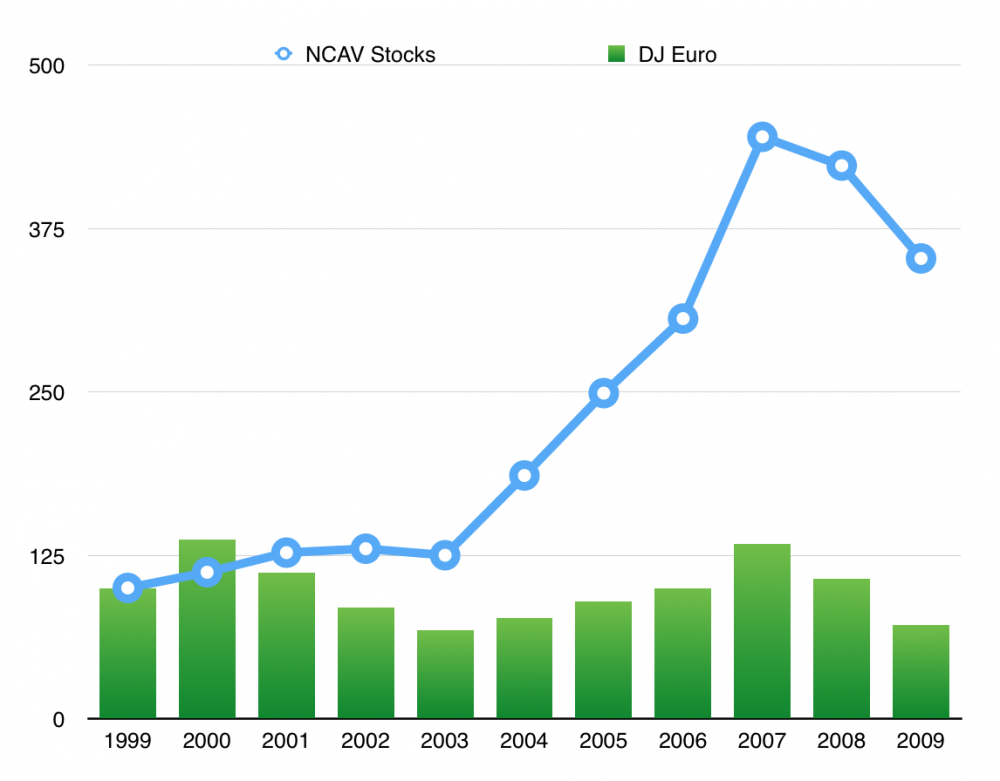

Let’s look at these long term returns as shown by the paper, “Studying Different Systematic Value Investing Strategies,” by Philip Vanstraceele and Luc Allaeys:

As you can see, net nets outperform in 9 out of 10 years, and only suffer 3 down periods.

An investor could easily turn those down years into permanent losses, however, if he sold out after the market dropped. When it comes to any investment strategy, you’ll inevitably have good years and bad years but it’s the average of all of those years that really counts at the end of the day.

Here, $1 invested at the start would have became:

- Net Nets: $3.53

- DJ Erurostoxx: $0.73

…by the end of 2009. You would have seen a 350% gain while, despite being subjected to the largest recession over the past 100 years!

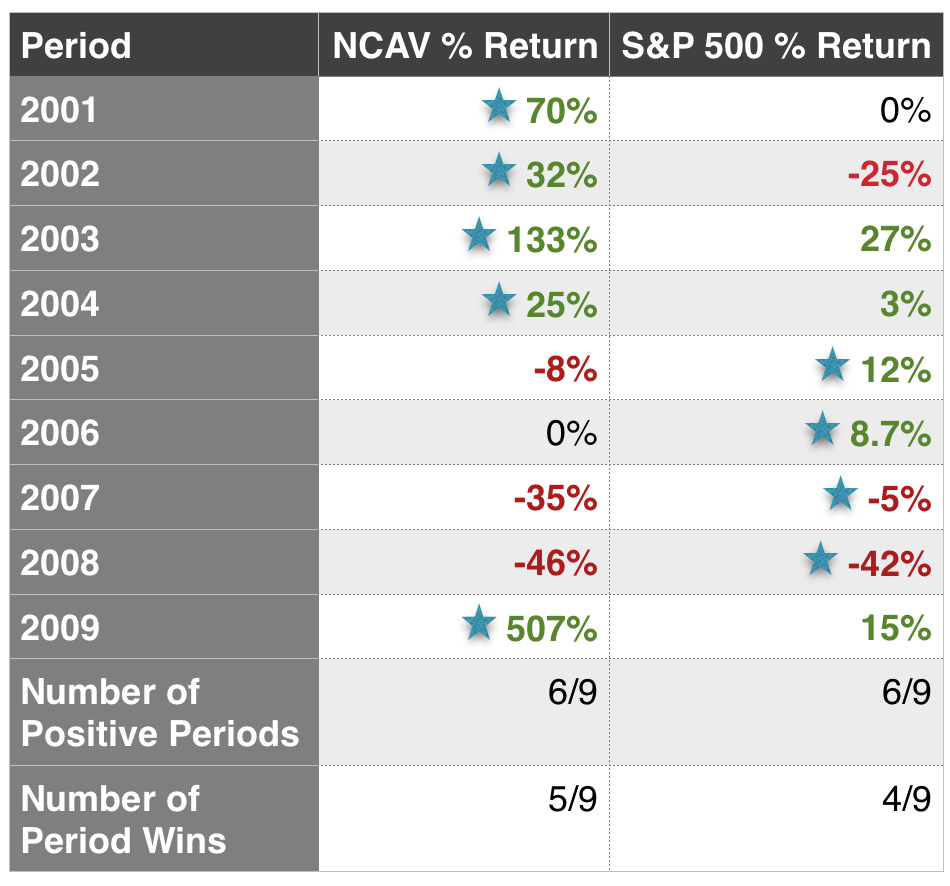

Now let’s take a look at Jae Jun’s Old School Value NCAV backtest:

Jae’s study also covers the first ten years of the 2000s, a tumultuous decade for stocks that included the Great Recession.

As you can see, the road was rockier but the ultimate payoff much larger.

Even with the large 2007 & 2008 dips, $1 invested in net nets would have grown to $12.81 while the same dollar invested in the S&P 500 would have shrank to $0.96!

$1 becomes…

- Net Nets: $12.81

- S&P 500: $0.96

…in just 9 years.

And it’s at this point that I have to mention one critical fact: temperament would have made all the difference over that 2007, 2008 stretch. Warren Buffett agrees. From his 2014 letter,

“If the investor …fears price volatility, erroneously viewing it as a measure of risk, he may, ironically, end up doing some very risky things.”

Warren Buffett 2014 letter to shareholders

…such as selling out during a market bottom to avoid the pain of a paper loss, only to miss the inevitable rebound. This is a classic trap investors find themselves in. While market drops are not avoidable, you can act in ways that will optimise your long term performance.

It’s a consistent approach, or staying the course over a number of years, that would have protected an investor’s downside.

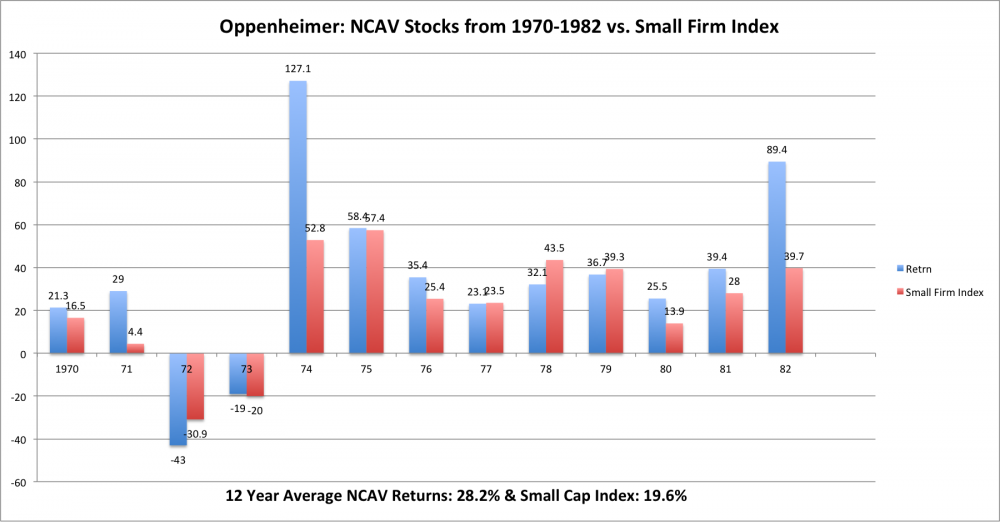

Let’s look at an earlier study, during a better period for stocks, generally. Let’s look at J. Robert Oppenheimer’s 1970 to 1982 net net stock study, Ben Graham’s Net Current Asset Values, A Performance Update:

In this study, net net stock investors would have suffered just 2 down years in 12, but those down years were fairly large. Again, if an investor had gotten frustrated and sold out after the second loss then he would have certainly missed out on the rocket ship-like returns in 1974, and great returns throughout the remaining 8 years.

In Oppenheimer’s study, $1 invested at the start of 1970 would have became…

Net Nets: $25.92

Small Firm Index: $10.20

…in 12 years. That’s a CAGR of over 31%!

Short Term Investors Need Not Apply

It’s this sort of diversification, both in the number of stocks in your portfolio and the number of years that you employ the strategy, that guarantee your downside is protected. Quite frankly, if you don’t have the temperament to stick to a promising strategy over the long run then you should be in an index fund an shouldn’t be picking stocks at all.

…but if you do have the ability to stay the course, net nets offer spectacular upside potential while protecting your downside.

In the End…

For the record, the results shown here are indicative of the returns on offer for widely diversified portfolios. As good as these results are, by focusing on the highest quality net net stocks you should be able to do even better.

That’s what Evan Bleker’s chosen to do and it’s worked quite well at 22.5% annual CAGR for the past 5 years.

Do you have the stomach to do this too?