Do you know that China has the most number of companies in the Fortune Global 500?

China has 124 while the US has 121.

This is the first time that the Chinese companies has outnumbered the American ones in the Fortune Global 500. History has been made and it goes to show the rising prominence of China in the world stage – not just politically but also in the business arena.

Fortune Global 500 has a simple methodology, it ranks all the companies by revenue. Well, you may say that China has an unfair advantage because of its massive population. Precisely, that’s the point. China has a super huge domestic market that is getting more affluent and it means good business for the Chinese companies.

In my opinion, this is just the start for them. As investors, we can participate in the growth of China by investing in their stocks.

We know that China has a lot of state-owned enterprises, which are impossible for us to access. But there are also prominent listed companies that we can invest in.

I did the job for you by identifying the listed Chinese companies that are in the Fortune Global 500 – there were 53 of them.

Here’s the list:

Rank #18 – China State Construction Engineering Corp (CSCEC) (SSE:601668) – US$206b Revenue

- PE Ratio: 5

- PB Ratio: 0.8

- Dividend Yield: 3.7%

- EPS Annual Growth Rate (5 years): 12%

The company has a presence in Singapore, constructing our HDBs and public buildings.

It also has a property development arm, CSC Land – its first residential project in Singapore is Twin View at 91 West Coast Vale.

Rank #21 – Ping An Insurance (SEHK:2318) / (SSE:601318) – US$184b Revenue

- PE Ratio: 11

- PB Ratio: 2.1

- Dividend Yield: 2.6%

- EPS Annual Growth Rate (5 years): 26%

Listed in both Hong Kong and Shanghai, it is the second largest insurance company in the world, just behind Berkshire Hathaway.

Rank #24 – ICBC (SEHK:1398) / (SSE:601398) – US$177b Revenue

- PE Ratio: 5

- PB Ratio: 0.6

- Dividend Yield: 6.7%

- EPS Annual Growth Rate (5 years): 1%

ICBC is the largest bank in the Fortune Global 500, ahead of JP Morgan.

Rank #30 – China Construction Bank (SEHK:939) / (601939) – US$159b Revenue

- PE Ratio: 5

- PB Ratio: 0.6

- Dividend Yield: 6.5%

- EPS Annual Growth Rate (5 years): 2%

China Construction Bank provides a wide range of financial services to both corporate and personal customers.

Rank #35 Agricultural Bank of China (SEHK:1288) / (SSE:601288) – US$147b Revenue

- PE Ratio: 4

- PB Ratio: 0.5

- Dividend Yield: 7.9%

- EPS Annual Growth Rate (5 years): 0%

Another bank, Agricultural Bank of China provides international commercial banking and financial services.

Rank #43 – Bank of China (SEHK:3988) / (SSE:601988) – US$135b Revenue

- PE Ratio: 4

- PB Ratio: 0.4

- Dividend Yield: 8.2%

- EPS Annual Growth Rate (5 years): 0%

Bank of China should not be foreign to most of us, given its presence in Singapore, you may even own a couple of its credit cards.

Rank #45 – China Life Insurance (SEHK:2628) / (SSE:601628) – US$131b Revenue

- PE Ratio: 9

- PB Ratio: 1.1

- Dividend Yield: 4.4%

- EPS Annual Growth Rate (5 years): 13%

As its name suggests, China Life Insurance provides life, annuity, accident, and health insurances to its customer base.

Rank #52 – SAIC Motor (SSE:600104) – US$122b Revenue

- PE Ratio: 11

- PB Ratio: 0.9

- Dividend Yield: 4.5%

- EPS Annual Growth Rate (5 years): -6%

One of the big four automotive manufacturers in China. Joint ventures with Volkswagen and General Motors to sell their brands in China.

Rank #54 – China Railway Construction (CRCC) (SEHK:1186) / (SSE:601186) – US$120b Revenue

- PE Ratio: 4

- PB Ratio: 0.4

- Dividend Yield: 4.1%

- EPS Annual Growth Rate (5 years): 5%

China Railway Construction is in the construction business, serving the various sectors including survey, Design, and Consultancy, Manufacturing, Real Estate, and more.

Rank #65 – China Mobile (SEHK:941) – US$109b Revenue

- PE Ratio: 9

- PB Ratio: 0.9

- Dividend Yield: 6.1%

- EPS Annual Growth Rate (5 years): -4%

The largest mobile network operator in the world in terms of subscribers, as of Jun 2020. Its subscribers of 947 million is more than double that of second placed Bharti Airtel with 420 million subscribers.

Rank #78 – China Communications Construction (SEHK:1800) / (SSE:601800) – US$109b Revenue

- PE Ratio: 4

- PB Ratio: 0.3

- Dividend Yield: 6.3%

- EPS Annual Growth Rate (5 years): 2%

They provide infrastructure construction, infrastructure design and dredging services.

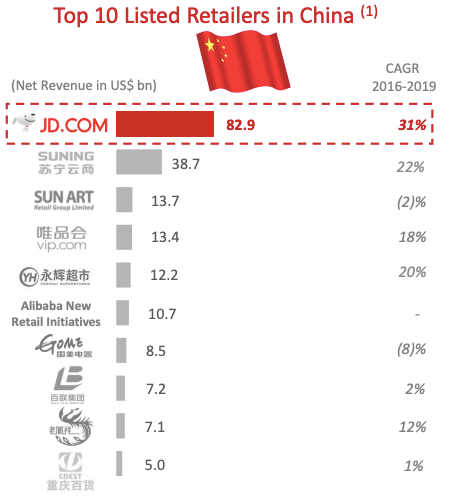

Rank #102 – JD.com (SEHK:9618) – US$84b Revenue

- PE Ratio: 58

- PB Ratio: 5.3

- Dividend Yield: 0%

- EPS Annual Growth Rate (5 years): NA

Rank #112 – People’s Insurance Co. of China (PICC) (SEHK:1339) / (SSE:601319) – US$80b Revenue

- PE Ratio: 5

- PB Ratio: 0.5

- Dividend Yield: 5.2%

- EPS Annual Growth Rate (5 years): 0%

Specialising in insurance, the People’s Insurance Co. of China offers a wide range of insurance products for both private and corporate sectors.

Rank #132 – Alibaba (SEHK:9988) – US$73b Revenue

- PE Ratio: 29

- PB Ratio: 9.6

- Dividend Yield: 0%

- EPS Annual Growth Rate (5 years): 33%

Rank #145 – Sinopharm (SEHK:1099) – US$71b Revenue

- PE Ratio: 8

- PB Ratio: 1.0

- Dividend Yield: 3.6%

- EPS Annual Growth Rate (5 years): 9%

Sinopharm distributes pharmaceutical and healthcare products within China.

Rank #147 – Country Garden (SEHK:2007) – US$70b Revenue

- PE Ratio: 5

- PB Ratio: 1.2

- Dividend Yield: 6.5%

- EPS Annual Growth Rate (5 years): 42%

They are the ones who built the famous residential project on a man-made island between Johor and Malaysia.

Rank #152 – China Evergrande (SEHK:3333) – US$69b Revenue

- PE Ratio: 22

- PB Ratio: 1.3

- Dividend Yield: 9.7%

- EPS Annual Growth Rate (5 years): 163%

China Evergrande is involved in the development, investment, and management of real estate properties. Evergrande defaults – read here

Rank #158 – China Telecom (SEHK:728) – US$67b Revenue

- PE Ratio: 9

- PB Ratio: 0.5

- Dividend Yield: 5.0%

- EPS Annual Growth Rate (5 years): -2%

As its name suggests, China Telecom provides wireline and mobile telecommunications services.

Rank #162 – Bank of Communications (SEHK:3328) / (SSE:601328) – US$67b Revenue

- PE Ratio: 3

- PB Ratio: 0.4

- Dividend Yield: 8.8%

- EPS Annual Growth Rate (5 years): 0%

They provide banking and financial services. Bank of Communications has also expanded its operations overseas into markets like New York, Tokyo, United Kingdom, Singapore, and more.

Rank #176 – Greenland (SSE:600606) – US$62b Revenue

- PE Ratio: 6

- PB Ratio: 1.1

- Dividend Yield: 5.8%

- EPS Annual Growth Rate (5 years): 21%

Greenland develops, markets and leases properties within China. Although a relatively young company, it has expanded its operations into second-hand housing agency, financial services, lease of industrial parks, commercial & hotel operation, metro investment industry and entrusted construction management services.

Rank #187 – China National Building Material (SEHK:3323) – US$58b Revenue

- PE Ratio: 8

- PB Ratio: 1.0

- Dividend Yield: 3.6%

- EPS Annual Growth Rate (5 years): 80%

Boasting a world’s largest cement producer with capacity of 525 million tons and a concrete capacity of 460 million tons.

Rank #189 – China Merchants Bank (SEHK:3968) / (SSE:600036) – US$57b Revenue

- PE Ratio: 9

- PB Ratio: 1.5

- Dividend Yield: 3.5%

- EPS Annual Growth Rate (5 years): 11%

China Merchants Bank serves both individuals and corporate clients through a range of banking services.

Rank #193 – China Pacific Insurance (SEHK:2601) / (SSE:601601) – US$56b Revenue

- PE Ratio: 6

- PB Ratio: 1.0

- Dividend Yield: 5.9%

- EPS Annual Growth Rate (5 years): 11%

China Pacific Insurance offers its clientele a wide range of insurance products from Life insurance to Property insurance.

Rank #197 – Tencent (SEHK:700) – US$55b Revenue

- PE Ratio: 43

- PB Ratio: 10.2

- Dividend Yield: 0.2%

- EPS Annual Growth Rate (5 years): 27%

We’ve talked about Tencent being a closet venture capitalist previously.

Rank #206 – Guangzhou Automotive Industry (SEHK:2238) / (SSE:601238) – US$54b Revenue

- PE Ratio: 9

- PB Ratio: 0.8

- Dividend Yield: 3.3%

- EPS Annual Growth Rate (5 years): 7%

Guangzhou Automotive Industry is involved in the research and development, manufacturing, sales and after-sales services of passenger vehicles, commercial vehicles, motorcycles and auto parts. They are also involved in the import and export of automobile-related products and other related operations.

Rank #208 – China Vanke (SEHK:2202) / (SZSE:000002) – US$53b Revenue

- PE Ratio: 6

- PB Ratio: 1.3

- Dividend Yield: 4.7%

- EPS Annual Growth Rate (5 years): 18%

China Vanke operates in the real estate industry, with a focus on the development and sale of properties.

Rank #210 – Wuchan Zhongda (SSE:600704) – US$52b Revenue

- PE Ratio: 8

- PB Ratio: 1.1

- Dividend Yield: 5.2%

- EPS Annual Growth Rate (5 years): 19%

Wuchan Zhongda engages in the domestic and international trading, manufacturing, real estate development and management, finance, and capital investment industries.

Rank #217 – Aluminum Corp of China (SEHK:2600) / (SSE:601600) – US$52b Revenue

- PE Ratio: -402

- PB Ratio: 0.5

- Dividend Yield: 0%

- EPS Annual Growth Rate (5 years): 26%

They deal with non-ferrous metals such as alumina, bauxite and other raw materials.

Rank #220 – Shanghai Pudong Development Bank (SSE:600000) – US$51b Revenue

- PE Ratio: 6

- PB Ratio: 0.6

- Dividend Yield: 6.1%

- EPS Annual Growth Rate (5 years): 1%

Shanghai Pudong Development Bank provides banking and financial services to the retail and corporate sectors.

Rank #222 – Industrial Bank (SSE:601166) – US$51b Revenue

- PE Ratio: 5

- PB Ratio: 0.7

- Dividend Yield: 4.7%

- EPS Annual Growth Rate (5 years): 6%

Industrial Bank provides a range of corporate and personal banking services.

Rank #224 – Lenovo (SEHK:992) – US$51b Revenue

- PE Ratio: 11

- PB Ratio: 2.3

- Dividend Yield: 5.4%

- EPS Annual Growth Rate (5 years): 14%

One of the proudest moment for them was when Lenovo acquired IBM’s personal computer business in 2005. Lenovo now owns the ThinkPad laptop and tablet lines.

Rank #234 – Xiamen C&D (SSE:600153) – US$49b Revenue

- PE Ratio: 5

- PB Ratio: 0.8

- Dividend Yield: 5.6%

- EPS Annual Growth Rate (5 years): 15%

Xiamen C&D operates supply chains for pulp and paper, iron and steel, minerals, etc. It also develops real estate properties.

Rank #239 – China Minsheng Bank (SEHK:1988) / (SSE:600016) – US$49b Revenue

- PE Ratio: 5

- PB Ratio: 0.5

- Dividend Yield: 6.8%

- EPS Annual Growth Rate (5 years): 1%

China Minsheng Bank provides corporate and personal banking services. They are also involved in the treasury business, finance leasing, assets management, and other financial services.

Rank #250 – AIA (SEHK:1299) – US$47b Revenue

- PE Ratio: 25

- PB Ratio: 2.2

- Dividend Yield: 1.6%

- EPS Annual Growth Rate (5 years): 25%

AIA is a well-known name in Singapore but it derived a large chuck of its revenue from China. For 1H2020, Singapore and China contributed 8% and 38% of AIA’s revenue respectively.

Rank #253 – China Everbright (SEHK:165) – US$47b Revenue

- PE Ratio: 11

- PB Ratio: 0.5

- Dividend Yield: 4.2%

- EPS Annual Growth Rate (5 years): -21%

China Everbright provides financial services in China.

Rank #290 – China Unicom (SEHK:762) / (SSE:600050) – US$42b Revenue

- PE Ratio: 12

- PB Ratio: 0.5

- Dividend Yield: 3.0%

- EPS Annual Growth Rate (5 years): -7%

China Unicom serves the telecommunications industry, some of its services include broadband and mobile data services, data and internet application and sales of telecommunications products.

Rank #301 – Jardine Matheson (SGX:J36) – US$41b Revenue

- PE Ratio: -216

- PB Ratio: 0.4

- Dividend Yield: 4.4%

- EPS Annual Growth Rate (5 years): 21%

The only SGX-listed counter in this list, Jardine Matheson owns a wide variety of businesses performed by its subsidiaries – Dairy Farm runs supermarkets (Giant, Cold Storage); Hongkong Land holds premium real estate in Hong Kong; Jardine C&C distributes cars (Mercedes, Mitsubishi, Kia); Mandarin Oriental operates hotels; and many more.

Rank #307 – Midea (SZSE:000333) – US$40b Revenue

- PE Ratio: 21

- PB Ratio: 4.6

- Dividend Yield: 2.4%

- EPS Annual Growth Rate (5 years): 15%

Midea is one of the world’s top aircon brands. Available in Singapore too.

Rank #324 – Suning.com (SZSE:002024) – US$39b Revenue

- PE Ratio: 11

- PB Ratio: 1.0

- Dividend Yield: 0.5%

- EPS Annual Growth Rate (5 years): 75%

Suning.com is a retailer China. It acquired a majority stake in Inter Milan.

Rank #328 – CK Hutchison (SEHK:1) – US$38b Revenue

- PE Ratio: 5

- PB Ratio: 0.4

- Dividend Yield: 6.5%

- EPS Annual Growth Rate (5 years): -8%

Watsons is one of the many subsidiaries of the Li Kashing controlled CK Hutchison.

Rank #343 – Jiangxi Copper (SEHK:358) / (SSE:600362) – US$37b Revenue

- PE Ratio: 16

- PB Ratio: 0.6

- Dividend Yield: 1.2%

- EPS Annual Growth Rate (5 years): 64%

Jianxi Copper is China’s largest copper producer.

Rank #353 – China Energy Engineering (SEHK:3996) – US$36b Revenue

- PE Ratio: 5

- PB Ratio: 0.4

- Dividend Yield: 4.7%

- EPS Annual Growth Rate (5 years): 1%

Rank #361 – CRRC (SEHK:1766) / (SSE:601766) – US$35b Revenue

- PE Ratio: 8

- PB Ratio: 0.6

- Dividend Yield: 5.1%

- EPS Annual Growth Rate (5 years): 0%

Rolling stock for the Thomson–East Coast line is built by Kawasaki Heavy Industries & CRRC Qingdao Sifang (a subsidiary of CRRC).

Rank #367 – Anhui Conch (SEHK:914) / (SSE:600585) – US$34b Revenue

- PE Ratio: 8

- PB Ratio: 1.9

- Dividend Yield: 3.9%

- EPS Annual Growth Rate (5 years): 43%

Anhui Conch manufactures and sells cement and commodity clinker.

Rank #369 – Jinchuan (SEHK:2362) – US$34b Revenue

- PE Ratio: -53

- PB Ratio: 1.6

- Dividend Yield: 0.1%

- EPS Annual Growth Rate (5 years): NA

Jinchuan Group is in the business of buying and selling of mineral and metal products.

Rank #392 – China Taiping Insurance (SEHK:966) – US$32b Revenue

- PE Ratio: 9

- PB Ratio: 0.6

- Dividend Yield: 2.5%

- EPS Annual Growth Rate (5 years): 15%

Yup, they are in the insurance business. And they are also in Singapore.

Rank #401 – Ansteel (SZSE:000898) – US$31b Revenue

- PE Ratio: 29

- PB Ratio: 0.5

- Dividend Yield: 2.1%

- EPS Annual Growth Rate (5 years): NA

Angang Steel manufactures and sells iron and steel products.

Rank #422 – Xiaomi (SEHK:422) – US$30b Revenue

- PE Ratio: 56

- PB Ratio: 6

- Dividend Yield: 0%

- EPS Annual Growth Rate (5 years): NA

Rank #423 – Shanghai Construction (SSE:600170) – US$30b Revenue

- PE Ratio: 9

- PB Ratio: 1.1

- Dividend Yield: 4.4%

- EPS Annual Growth Rate (5 years): 13%

As its name suggests, Shanghai Construction is in the construction business.

Rank #436 – Gree Electric Appliances (SZSE:000651) – US$29b Revenue

- PE Ratio: 19

- PB Ratio: 3.0

- Dividend Yield: 2.2%

- EPS Annual Growth Rate (5 years): 17%

Rank #442 – Shenzhen Investment (SEHK:604) – US$29b Revenue

- PE Ratio: 5

- PB Ratio: 0.5

- Dividend Yield: 7.5%

- EPS Annual Growth Rate (5 years): 6%

Shenzhen Investment is a real estate developer. It has since expanded into related industries.

Rank #473 – Shanghai Pharmaceuticals (SEHK:2607) / (SSE:601607) – US$27b Revenue

- PE Ratio: 8

- PB Ratio: 0.8

- Dividend Yield: 3.6%

- EPS Annual Growth Rate (5 years): 8%

Shanghai Pharmaceuticals is involved in research and development, manufacture, distribution, and retail of pharmaceutical products.

Rank #499 – Yangquan Coal Industry (SSE:600348) – US$25b Revenue

- PE Ratio: 8

- PB Ratio: 0.7

- Dividend Yield: 6.0%

- EPS Annual Growth Rate (5 years): 121%

Yangquan Coal Industry is involved in the production and distribution of anthracite coal.

The rise of China

Chinese companies have wrestled the dominance in Fortune Global 500 from the Americans.

You may not be familiar with some of these companies because they derive most of their businesses within China. And yes, it is possible to amass such huge revenues due to the size of the Chinese market.

Their next step would be to expand to the rest of the world and I think this shift is happening at this very moment – we see their presence in Singapore today.

I hope this list will warm you up to the companies and hopefully you can get some investment ideas!

‘m surprised to see JD beat Alibaba and Tencent in revenue. However, the stock price is reflecting a different story. Haha. Anyway, time to pick up more. 🙂

Is there an ETF that comprises of most of these companies?

There should be plenty of indices that covers most of these companies. Off the bat I can think of MSCI China and CSI 300.