What is common between these two actions?

- Take a small profit early.

- Hold on to your loss and allow it to grow bigger and bigger.

“Pain”!!

If I do not take the profit now, the market may take it back tomorrow. Taking small profit is less painful than giving it back to the market.

If I do not cut the loss, I still have the chance that the market may give it back to me tomorrow. Paper loss is less painful than a real loss.

Is that what you, as a trader, have been doing, repeatedly?

I am not a trader or investor per se, yet I was fascinated by the phenomenon that “smart people make dumb decisions in the market”. I was interested to find out why, and I searched on the internet using this phrase. The search result turned out to be 3,290,000 articles, which reaffirmed my curiosity to dip deep into the core issue.

“The one thing everyone on the planet has in common is the undeniable fact we’ve all made our fair share of regrettable decisions. Show me someone who hasn’t made a bad decision and I’ll show you someone who is either not being honest, or someone who avoids decisioning at all costs. Making sound decisions is a skill set that needs to be developed like any other.”

- Mike Myatt, Forbes Mar 28, 2012

Buy low, sell high. Is it so easy? When it comes to investments, many of us are swayed more by feelings and intuition than by sound judgment. It draws attention to the risks posed by implicit cognitive biases on an investor’s bottom line.

Phobia of failure

To compound the trader’s problem, our society has a phobia of mistakes and failures. Cutting losses is to admit that we are wrong, which is a pain we try to avoid.

In school, we are taught to follow a set of rules, and we are not taught to form our own goals and to figure out how to achieve them. We develop a fear of the unknown, and an apprehension of uncertainty.

I am hopeful that our education system will improve. I bumped into STEM in education by chance and I find it very interesting.

STEM stands for Science, Technology, Engineering and Mathematics.

A search of the Education Week archives has shown that educators were starting to combine the subjects before 2001.

Many sources around the Internet attribute the acronym to Judith A. Ramaley, who was the assistant director for education and human resources at the National Science Foundation from 2001 to 2004.

STEM is more than just a grouping of subject areas. It is a movement to develop the deep mathematical and scientific underpinnings students need to be competitive in the 21st-century.

This movement goes far beyond preparing students for specific jobs.

STEM develops a set of thinking, reasoning, teamwork, investigative, and creative skills that students can use in all areas of their lives.

I feel STEM will better prepare a person to be smarter in money decisions – it reframes failure as a necessary part of life.

Here’s some guidelines on how to make good decisions:

- You don’t need more info, you need the right info: Clarify the problem and get relevant data, not all the data.

- Feelings are not the enemy: For simple choices, use raw brainpower. For complex choices, trust intuition.

- If you’re an expert in the area, trust your gut: Not sure if you’re an expert? Keep a decision diary.

- “Good enough is almost always good enough”: Trying to be perfect makes your brain miserable.

Take Away

We avoid cutting losses and admit failures, a direct result of how we learn, aka, “conditioning”, in school.

Allow me to share with you how most investors and traders have unrealistic expectations of returns, as a result of the mindset that was inculcated in school.

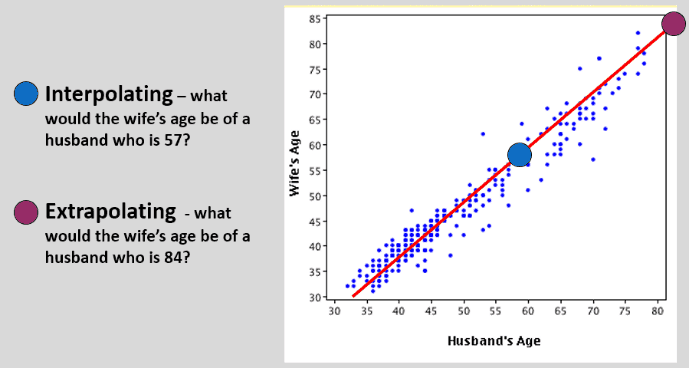

Prediction: Interpolation and Extrapolation

Look for patterns.

Predicting the future is all about understanding patterns and cycles.

In the example picture above, data was collected to show the age difference between husbands and wives (blue dots). A “Line-of-Best-Fit” can be constructed using statistical methods to define a trend (red line). In this instance the trend says “the older the husband, the older the wife”.

The “Line-of-Best-Fit” helps us to make predictions using Interpolation and Extrapolation.

In Latin, “Inter” means “Inside” and “Extra” means “Outside”.

- Interpolating: Estimating a value BETWEEN two measurements in a set of data.

- Extrapolating: Predicting a value BEYOND the range of a set of data.

In short, interpolation is to define the relationship inside a set of known data; extrapolation is to extend the “Line-of-Best-Fit” to predict the future.

The majority of predictions are yes or no answers. Either it’s going to rain, or it’s going to be sunny. So, even if you end up guessing, you have a 50 percent chance of being right.

Fundamental Analysis (FA) and Technical Analysis (TA) are all historical data based interpolation into extrapolation. In other words, to use history to predict the future.

Charting the market action (price movements) coupled with the use of technical indicators is a common technique to identify the pattern and hope to see the same pattern to occur again in the future.

We all know the market is composed of human (the “crowd”) and it is driven more as a result of how the “crowd” in the market feels about it to move the price up and down. The randomness of the market will never produce IDENTICAL pattern, rather, SIMILAR (look-alike) patterns are more likely. Lack of the IDENTICAL pattern is the prime reason why nobody can find a method with 100% accurate predictive power.

Please, stop trying to find a Holy Grail strategy because it doesn’t exist. You need to shift your mindset to think in a probabilistic manner.

Take Away

Without the probability mindset, it is difficult for us to perform in uncertainty, aka, the market. We keep looking for the patterns to repeat with 100% accuracy but the randomness of the market never offers such predictability.

Adopting Probabilistic Thinking

Here comes another question for seasoned retail traders.

What is Your Win Rate? – Meaning: out of 100 trades, how many are winners?

I bet few have firm answers as few retail traders keep track of their performance.

Let’s hear from the pros.

My best trader makes money only 63 percent of the time.

Most traders make money only in the 50 to 55 percent range.

That means you’re going to be wrong a lot.

– Steve Cohen of SAC Capital, via Stock Market Wizards

From June 2006 to October 2013, [I] examined 1,866 investments, representing a total of 30,874 trades made by 45 of the world’s top investors. [I] was shocked to find only 49% (920 investments) made money.

– Lee Freeman-Shor, The Art of Execution

If the pros win only around the 50% win rate, does it mean that flipping a coin to enter the market is a possible option to trade?

Coin-Flip Entry system can make money! However, most people will not accept this idea, as it is against their “normal” belief system. The entry is the least important, there are other required conditions to make coin-flipping entry work.

I once read about a story.

A wealth lady took a $1B bank check to the casino and walked up to the Roulette table. She said, “All on red”. The croupier manning the table replied softly, “Madam, we have table limits”.

We all know the casino games are designed to have an edge in favour of the casino. They will win in the long term. Why, then, all casino impost the table limit?

Probability requires large numbers to determine the trend or “edge”.

I played the coin-flip game for few years and I collected the results. In the left hand side of the picture, there is a chart, which is long and narrow; and the small one on the right hand side is short and wide.

The long and narrow chart comes from the result of around 3000 coin-flips. The short and wide chart comes from only 180 coin-flips.

I shall write another article on the game of coin-flipping.

The law of large numbers was first proved by the Swiss mathematician Jakob Bernoulli in 1713.

The law of large numbers is a principle of probability according to which the frequencies of events with the same likelihood of occurrence even out, given enough trials or instances. As the number of experiments increases, the actual ratio of outcomes will converge on the theoretical, or expected, ratio of outcomes. The charts above confirm the principle.

Casinos understands the power of probability. The table limit is their tool to protect them from the randomness of event. Just like the “stop loss” to protect the traders from the randomness of the market. No one can predict the OUTCOME of the next game, the table limit allows the casino to control their risk. They can afford to see losing streaks of small sums, sometimes, $1M is a small sum to the casino.

If they allow no table limit, the $1B can actually kill the casino, because of the unpredictability of the OUTCOME. The table limit drives the lady to play the game many times, she will win some, lose some and eventually lose everything if she played long enough.

Large number of OUTCOME produces the predictable OCCURRENCE that keeps the casino not only in business, but to make tons of money. All they need is the crowd to give them the large numbers.

To clarify:

OUTCOME – the unpredictable single event occurring anytime as a result of the play.

OCCURRENCE – the predictable series of events (large numbers) to match the “edge”.

If we translate the property of OUTCOME and OCCURRENCE into a system of trading, making money in the long term will be the only result.

Take Away

The “Holy Grail” of consistently winning in the market is to think about probabilities, and to accept that losses are part and parcel of achieving profits in the long run. Do not let the OUTCOME over shadow your OCCURRENCE.

How to develop the system applying the probabilistic approach? That will be the story for the future.

Thank you for the article and would like to receive new posts.

very informative article. As someone who likes to read and write and trade as well, the first word that came to my mind wasn’t pain but Decision. In a market that is heavily propped by low or negative interest rate, dismal corporate earnings and scandalous and entertaining politics, one can never be at a better time to take advantage of this market.

It is said that the market moves in 3 ways, up, down or sideway. There is a 4th one, ie. not participating and sitting on the side fence. When the market moves finally, we hear common laments like : Had I known, I would put in more money…..or Lucky me, I was smart enough to get out before the crash, or maybe……the market is too uncertain, let’s wait for the next tide to come first……

Who’s right and who’s wrong? Does it really matter? Metaphorically, some take on trading as a past-time like playing Pokemon, catch it when you have time while others pour hours to pierce through the screen, hoping to find the Holy Grail.

For me, it is a great opportunity to buy and also to sell, depending on the assets class. That makes the game of investment interesting, much like a seesaw I played when I was a kid. When one side goes up, the other side goes down.

Cheers