I believe as a parent, you would want to provide your child with the best education you can afford. A university education seems to be the goal for most parents. It is evident as the number of graduates in Singapore have increased over the years. With a ‘kiasu’ mentality, it is natural to worry about your child being deprived of a bachelor’s degree when everybody else’s kids seem to have one.

Your child’s academic abilities aside, we want to make sure that you are able to fund your child’s university education. It is common knowledge that university education is on the rise and it would only get more expensive in the future as long as our culture remains. In this article, we will guide you through the cost projections so that you would know how much money you would need to set aside for your child.

Step 1 – Determining the Start State

We will use National University of Singapore (NUS) as a benchmark. For 2015, NUS is charging a Singapore Citizen $25,400/year for medicine, $12,400/year for law, and $7,950/year for most other courses such as Engineering. These fees are after the full Ministry of Education’s tuition grant. In total, you would have to pay almost $31,800 for a 4-year degree or $127,000 for an expensive 5-year medical degree.

Step 2 – Determine the Climb Rate

We will compare the 2015 course fees with 2008’s, as the latter were the earliest data we could find. Then we will take the compounding annual growth rate (CAGR) of the course fees over the years.

We have also included the fees for Singapore Permanent Residents and International Students in the following table.

| Tuition Fees for Singapore Citizen | 2008 | 2015 | CAGR |

| Medicine | $ 18,230 | $ 25,400 | 5% |

| Law | $ 7,340 | $ 12,400 | 8% |

| Engineering | $ 6,360 | $ 7,950 | 3% |

| Tuition Fees for Permanent Resident | 2008 | 2015 | CAGR |

| Medicine | $ 20,060 | $ 35,550 | 9% |

| Law | $ 8,080 | $ 17,350 | 12% |

| Engineering | $ 7,000 | $ 11,150 | 7% |

| Tuition Fees for International Student | 2008 | 2015 | CAGR |

| Medicine | $ 27,350 | $ 50,800 | 9% |

| Law | $ 11,010 | $ 24,800 | 12% |

| Engineering | $ 9,540 | $ 15,900 | 8% |

The rate of increase in tuition fees are higher for Permanent Residents and International Students across all courses.

Law has seen the highest climb in tuition fee. But if we average the cost increments for all 3 types of courses, we saw that university fees go up by 5% per year on the average.

Step 3: Project the Cost

The number of years to prepare for your child’s education would depend on his or her age. You also would not know what he or she would like to pursue in the future. But it is likely that you are able to tell if he or she is academically inclined based on the trend of his or her school results and standings.

But to play safe, it is better to prepare the sum enough for the most expensive course, which is medicine.

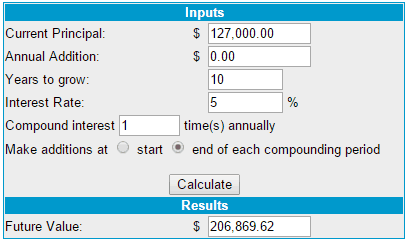

You can use a calculator from moneychimp. It is a simple interest calculator that works for this purpose too.

I have attached a screenshot to help you with the parameters to enter.

- Current Principal is the course fee in 2015 which you should refer in step 1. Remember to multiply the course fee by the number years to complete the course.

- Years to Grow is the number of years to your child’s university enrollment.

- Interest Rate is the CAGR found in step 2.

- Remember to click on the option of “Make additions at end of each compounding period”

There you go, the estimated cost of a medicine degree in 10 years’ time would be $206,869.62 for a Singapore Citizen studying in NUS.

It is important to note that we have yet to calculate the living allowance for your child. This is just mere education cost alone.

Step 4: Explore Options to Grow the Education Fund

One of the favourite options to fund for education fund is the endowment fund, as told by financial advisers. However, if we look at the increment rate for university courses of 3% and above, it is unlikely endowment policies can perform better than that. You would have to put in higher premiums to meet the savings goal.

Alternative options with higher returns would be corporate bonds and stocks. But it would be highly dependent on the length of the runway you have got. If your child is entering university within 5 years, it would be quite risky to put that capital into stocks. Corporate bonds would be relatively safer.

But few things in life are binary in nature. You can grow the education fund using a combination of tools. For example, buy a term insurance to provide coverage in case you pass away before you could save enough for your child’s education, buy a hospitalisation plan in the event you are so sick, set aside a sum of money in Singapore Savings Bonds to earn close to 3% per year safely, and invest some money in an index ETF for higher returns. The combination would probably lower your risk and increase your returns overall.

Please do not take what I have just said as financial advice. I am just giving you an idea how you could use a multi-solution approach. The actual strategy would differ from people to people.

Image credit: Gabriel Sai

It’s better not to go to Uni and spend that kind of money. In the Uni, one will learn a specialized skill which will be one’s undoing in the future. It is better to buy a piece of farmland in some far away country. There, one can build one’s home just with the cost of an axe and some sweat, grow some crops and dig a well for water.

Where are some of the places that caught your fancy besides Sang Lee?