NVIDIA (NVDA) will be releasing their second quarter of fiscal year 2022 financials on the 18th of August 2021 after market hours. Investors love this company, let’s examine their performance and growth story thus far to find out why.

NVDA delivered great returns for early investors

Year-to-date, Nvidia has rewarded shareholders with more than 50% gain. In the past 5 years, it gave patient shareholders a whopping 1,196.60% gain! (accurate at the point of writing)

If you have been invested with NVDA from the very beginning since its IPO on 22nd Jan 1999 at $12…22 years and 4 stock splits later, your stock return is now a massive 49,139.02%. $10,000 invested from the very beginning will give you $4.9 million as of 15 Aug 2021.

Your Compound Annual Growth Rate (CAGR) would be 30.92% for 23 years.

For the uninitiated, here’s a quick intro to:

What does Nvidia (NVDA) do?

In 1999, NVIDIA invented the Graphics Processing Unit (GPU) which is a specialised processor designed to accelerate graphics and video rendering. Rendering is the process involved in the generation of 3D images through application programmes.

From computer game graphics to revolutionising Artificial Intelligence (AI), the GPU now acts as the brain of computers, robots and autonomous driving that can perceive and understand the world.

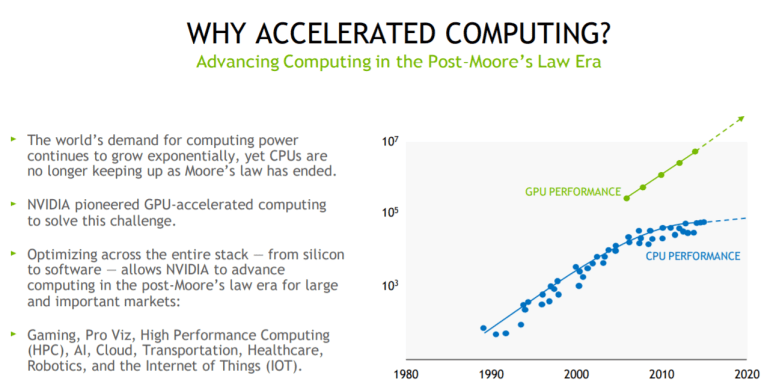

GPUs can process a huge amount of data simultaneously, are a lot more efficient and perform much more work for every unit of energy as compared to Central Processing Units (CPUs).

Both CPUs and GPUs are critical computing engines, they are silicon-based processors, but they have vastly different architectures and are designed for different purposes. Fast forward to today, GPUs have become a key part of modern supercomputing.

Moore’s Law states that the number of transistors on a microchip doubles every 2 years though the cost of computers is halved. However, Moore’s Law has reached a physical limit to create smaller chips because cooling down the smaller transistors takes more energy than the amount of energy that already passes through it.

To solve this problem, NVDA pioneered GPU-accelerated computing to cater to the world’s demand for more computing power.

NVIDIA: Market Leader in its space

High Performance Computing

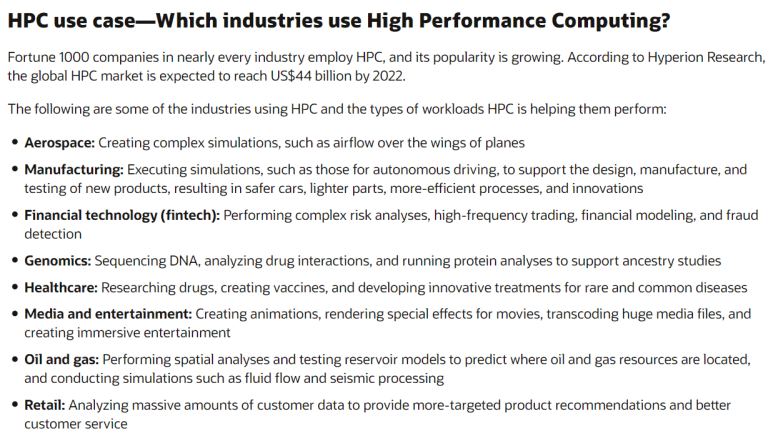

NVDA has over 90% market share of accelerators and 70% market share of the new TOP500 supercomputing systems. This makes them the leader in High Performance Computing (HPC) for data centers and AI.

Scientists, researchers, engineers and law enforcement officers use HPC to discover next-generation breakthroughs across a wide range of industries that include:

- pharmaceuticals,

- DNA sequencing,

- physics,

- weather patterns predictions,

- crime investigations and,

- technological advancements of the human race.

There are many use cases for AI and HPC to solve the world’s most important scientific, industrial and big data challenges. It allows users to process huge volumes of data and simulations at very high speeds.

Deep Learning

“Deep learning is a subset of AI and Machine Learning (ML) that uses multi-layered artificial neural networks to deliver state-of-the-art accuracy in tasks such as object detection, speech recognition, language translation and others.”

Nvidia Developer website

Unlike traditional machine learning, deep learning enables the machine to learn on its own, without programmers having to code everything. It processes massive volumes of data through neural networks, training them to perform tasks that are too complicated for any human coder to describe.

- In the automotive industry, they provide unmatched image recognition capabilities and is the key to autonomous driving technology.

- In medical and life sciences, deep learning allows scientists to accelerate medical data analysis, to discover new and produce more effective drugs faster than before.

The world’s cloud data centers are moving to deep learning and enterprises can save billions and billions of dollars from every predictive data outcome that they use. The faster they are able to put these data to practical use, the more time and money is saved.

And Nvidia’s technology is powering these advancements.

What I think of NVDA’s Financial Performance

Gaming (48.8%) and Data Center (36.2%) contributes to most of NVDA’s revenues and will continue to drive their growth.

Looking at the revenue trend (in table below), Professional, Auto and Others are unlikely to be a major contributor to NVDA’s future growth very soon.

Gaming Revenue will remain strong

Revenue from the Gaming segment will continue to be strong, with contributions from the beginning of the RTX 30 cycle. RTX 30 is NVDA’s 2nd Gen Ampere architecture designed for gamers and game developers. Their new RT Cores, Tensor Cores and streaming multiprocessors will allow game developers and content developers to run ray tracing graphics with cutting-edge AI features.

The old GTX graphics card will be too slow for gamers and developers to run their gaming applications that have a higher graphics demand.

Cryptomining could drive growth

The popularity of cryptocurrencies has also boosted crypto mining. The vast majority of mining is contributed by professional miners. Learning from past experience in 2018 during the crypto crash, NVDA had designed the NVIDIA CMP HX, a dedicated GPU for professional mining to differentiate their gaming GPU from mining GPU.

Potential response from NVDA 2Q22 Earnings

Management had guided $6.3 billion in revenues which gives them a Q/Q growth of 11% and a Y/Y growth of 63%. Looking at sequential growth would likely give them a growth projection of 30-40%.

Nvidia’s management is usually very conservative in guiding revenue estimates.

If they beat earnings slightly tonight, the stock price could dip a little because the P/E multiple is very expensive. Investors would only be satisfied with a huge earnings beat.

Update:

Nvidia earnings had beat expectations on 18th Aug:

- Earnings was at $2.18 per share, beating expectations of $1.97 per share

- Revenue was at $3.87 billion beatting the $3.65 billion as expected.

For the first time, its data center business has outperformed its gaming business, with a revenue growth of 167%. (Although a good portion of it came from Nvidia’s acquisition of Mallanox which contributed 14% of Nvidia’s overall revenue.)

Their guidance also looks strong with Nvidia calling for a $4.40 billion revenue in fiscal 3rd quarter.

NVDA’s current valuation

- Current market cap = $503 billion ($201.88)

- Estimated Next Twelve Months (NTM) net income = $9 billion

- NTM P/E ratio: 55.9X

NVDA’s NTM P/E ratio is about 55.9x which I find is quite expensive considering that they will only grow at most 40%. Investors are forward looking and using NTM P/E is more appropriate than using Last Twelve Months (LTM) P/E in this case.

If you’re interested to learn about how I find and evaluate hypergrowth stocks, join me at my SaaS Hypergrowth investing webinar.

Conclusion

NVDA is the market leader in both their core revenue segments. They have the biggest market share in Gaming GPU (81%) and Data Center HPC (70% of TOP500).

That said, they are already too big in size and hence their future growth is unlikely to be in the hypergrowth phase. I like this company and I believe that they can continue to grow well into the future. I would probably hold it if I had the stock and provided that there are no better ideas around.

However, as a hypergrowth investor, there are better companies that could potentially give me better returns than NVDA at the point of writing. If you’d like to grow your portfolio faster, I’ll be sharing how I pick better hypergrowth companies for my portfolio here.

Disclaimer: I’m not vested.