By now, it is probably known to everyone that Silicon Valley Bank (NASDAQ: SIVB) has collapsed.

Here we look at what happened, whats next and what you should or should not do.

Who is Silicon Valley Bank?

SIVB is a regional commercial bank based in Santa Clara, California. SIVB works closely with Silicon Valley tech startups. Its expertise is in the tech industry, supporting tech startups through the various stages of growth.

44% of US venture capital backed technology and healthcare IPOs were done through SIVB and many of these companies continue to bank with SIVB.

SIVB has a substantial market share in certain tech subsegments such as Consumer Internet, Enterprise Software, Life Science & Healthcare, Fintech, Frontier Tech and Cleantech industries

Well known customers include Etsy, Datadog, Crowdstrike, Roblox, Roku, Shopify, Upstart, Bill.com, Affirm, Payoneer, SoFi, Axsome Therapuetics, Quotient Technology, etc. the list goes on.

What happened last week?

SIVB collapsed.

SIVB was on a growth trajectory, nearly tripling its deposits in the last three years to $189 billion.

A bank makes money by lending out its deposits at higher margins than what it pays. As deposits grew so quickly, SIVB could not grow their loan book fast enough.

SIVB’s approach was to invest these deposits in mortgage backed securities and US treasury securities with duration of more than 10 years and a weighted average yield of a mere 1.56%. This amounted to around $90 billion.

A bank acts as an intermediary to match borrowers and depositors. A bank tends to be safe because it has a diversified pool of borrowers as well as a diversified pool of depositors. It also carries out risks assessment on potential borrowers to ensure that the depositor’s funds are protected.

In SIVB’s case, they did not have a diversified pool of depositors. 97.3% of their deposits were more than $250k each. This is because most of their customers were tech companies in the Silicon Valley tech hub and not retail individuals.

A bank also has to match the duration of its borrowings and deposits. Generally, banks operate with a duration mismatch as deposits can be withdrawn at almost anytime while its borrowings and investments tend to be of a longer duration. Generally for most large banks, this is not an issue as the pool of depositors are diversified and not everyone would withdraw their deposits at the same time.

In SIVB’s not only were their depositors of similar risk profile, many of their depositors were also depleting their account balance to make operational payments as fund raising dried up in these times. Once some of them caught wind that other customers were pulling out their funds, many rushed to follow suit.

SIVB had to sell some of their investments at losses to fund these withdrawals and when depositors caught wind, the withdrawals accelerated and this led to a bank run.

These investments were sold at a loss because the current interest rate environment is much higher than before. If the coupon payment of an investment was 2% and the current interest rate is 4.5%, this means that new investors would demand at least a 4.5% return. This means that the investments would have to be sold at a discount so as to achieve the 4.5% return.

If SIVB did not have so many customers carrying out withdrawals, they would probably have been able to hold these investments to maturity, which was their intent, just like any other commercial bank.

The other reason for the bank run was the fact that the bank was also technically insolvent as its fair value losses on its securities were higher than the equity held by the bank on the balance sheet.

We say technically insolvent because if the bank was able to hold its investments till maturity, they would have cured the fair value losses. Unfortunately, they were unable to do so because of the bank run.

What will happen next?

The US Federal Deposit Insurance Corporation (FDIC), as regulators, has stepped in to take control of the bank and manage the situation.

The FDIC acts in two capacities following a bank failure:

1) As the “Insurer” of the bank’s deposits, the FDIC pays deposit insurance to the depositors up to the insurance limit.

2) As the “Receiver” of the failed bank, the FDIC assumes the task of collecting and selling the assets of the failed bank and settling its debts, including claims for deposits in excess of the insured limit.

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

The FDIC has announced that insured depositors will have full access to their deposits no later than March 13th Monday morning.

The regulators have approved plans to backstop both depositors and financial institutions associated with Silicon Valley Bank to avoid contagion risks.

The Federal Reserve also said it is creating a new Bank Term Funding Program aimed at safeguarding institutions impacted by the market instability of the SVB failure.

It has been announced that there would be no bailouts and no taxpayer costs associated with any of the new plans. Shareholders and some unsecured creditors will not be protected and will lose all of their investments.

The regulators also identified a similar systemic risk exception for Signature Bank (SBNY) (NASDAQ: SBNY) which was closed today. Similarly, all depositors of SBNY will be made whole. As with the resolution of SIVB, no losses will be borne by the taxpayer.

Should you sell your regional banks because of this?

The regional banking ETF (NYSE: KRE) has fallen 16% in the week and 27% in the past year.

Many of the regional banks on the list have also fallen substantially this week amidst contagion fears and worries that this could be the first sign of a new financial crisis.

Share prices of banks that are more similar to SIVB in terms of profile and geographic location such as Western Alliance Bancorp (NYSE: WAL) and PacWest Bancorp (NASDAQ: PACW) fell more significantly.

These banks have all faced similar losses on investments and would likely underperform whether they sell their investments or hold them to maturity.

At this point, although a contagion is not on the table, since most banks have different profiles from SIVB, the biggest risk still remains – should the regulators be unable to quell fears, a bank run will occur simply from panic.

You probably shouldn’t sell your diversified banks because of this

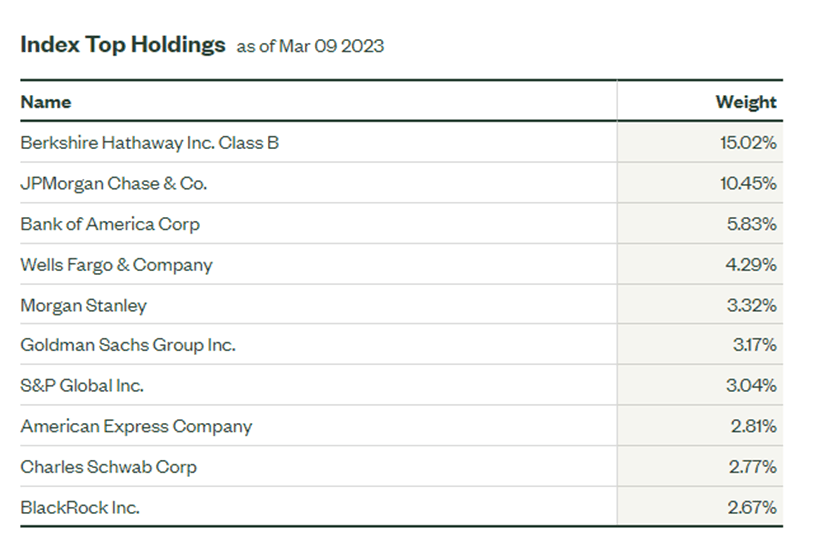

The financial sector ETF (NYSE: XLF) has fallen 8% in the week and 9% in the past year.

The larger financial institutions have broad diversified lenders and depositors base and better risk management profile and are unlikely to be substantially affected from this.

One of them could even end up acquiring SIVB and benefiting from the acquisition.

All banks would similarly be affected from fair value losses on yield bearing investments due to the higher interest rate environment, but these banks would have the risk management in place to hold these investments till maturity. Even for investments that they have designated as held for sale, a resilient bank would be able to change its strategy and hold these investments till maturity.

Maybe you should sell your tech stocks and stable coins instead?

Tech companies such as Roku and Roblox have informed that they have 5% and 25% of their cash banked in with SIVB respectively. Although they do not expect operations to be affected, we do not yet know the amount of deposits that can be recovered.

Companies who previously secured credit facilities with banks such as SIVB are now left without a backstop should they face a liquidity event.

Circle’s stablecoin USDC had $3.3 billion banked with SIVB and depegged, declining by 12% to $0.88 causing concern.

Closing statements

Treasury Secretary Janet Yellen has said that the banking system remains resilient, and she remains confident that the regulators for SIVB will take appropriate actions to resolve the situation.

There will be mark to market losses on coupon bearing instruments that pay less than the prevailing interest rate. Where the maturity tenor is long, this means that the investor will have to carry this instrument on their balance sheet at a loss until maturity where they will be able to redeem at par value.

Some analysts believe that this incident will make the Federal Reserve rethink its rate hike trajectory. We think this incident itself will not.

In an era where funding and liquidity is a top concern, the name of the game has changed from seeking growth to being prudent, maintaining ample liquidity and adequate credit facilities.