It is common to have two non-guaranteed returns stated in your endowment policy. A lower number and a higher number. It usually range from 3% to 5%.

Most people will take the returns at face value. Of course, financial advisors will caveat it is not guaranteed. But that is not the full story.

You need to know how to calculate your returns so that you can weigh your options to decide where your hard earned money will go to.

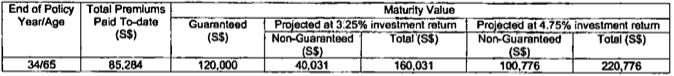

Here’s what a typical endowment plan would look like for the Surrender Value at maturity:

As this is a regular premium payment scheme, we need to use Internal Rate of Return (IRR) to calculate the returns over the years. Compound Annual Growth Rate (CAGR) is used if it is a lump sum premium paid only once.

Since the projected returns have two numbers 3.25% and 4.75%, we will have to break down the calculations into separate parts.

SCENARIO 1: Projected Returns of 3.25%

What you do not see is that the annual premium is $4,489 which is paid over a period of 19 years. The total premium paid would be $85,284.

The guaranteed return is $120,000 which means regardless of market condition, this amount is promised to you by the insurance company at maturity if you do not die prematurely. In addition, there is a non-guaranteed component of $40,031.

Adding the guaranteed and non-guaranteed benefits together we will get $120,000 + $40,031 = $160,031

The table below shows how you can set up the Excel Spreadsheet for the IRR calculation. The function to use is “=XIRR(values, dates)”. For the values, you highlight the cells for the premiums and withdrawal values. For dates, highlight the cells with the premiums and withdrawals were made. The portfolio value at the maturity has to be reflected as negative for the function to work.

| Year | Date | Premium |

| 1 | 1-Jan-15 | 4488.6 |

| 2 | 1-Jan-16 | 4488.6 |

| 3 | 1-Jan-17 | 4488.6 |

| 4 | 1-Jan-18 | 4488.6 |

| 5 | 1-Jan-19 | 4488.6 |

| 6 | 1-Jan-20 | 4488.6 |

| 7 | 1-Jan-21 | 4488.6 |

| 8 | 1-Jan-22 | 4488.6 |

| 9 | 1-Jan-23 | 4488.6 |

| 10 | 1-Jan-24 | 4488.6 |

| 11 | 1-Jan-25 | 4488.6 |

| 12 | 1-Jan-26 | 4488.6 |

| 13 | 1-Jan-27 | 4488.6 |

| 14 | 1-Jan-28 | 4488.6 |

| 15 | 1-Jan-29 | 4488.6 |

| 16 | 1-Jan-30 | 4488.6 |

| 17 | 1-Jan-31 | 4488.6 |

| 18 | 1-Jan-32 | 4488.6 |

| 19 | 1-Jan-33 | 4488.6 |

| 34 | 1-Jan-48 | -160,031 |

| Annual return: | 2.61% |

The annual return is actually 2.61% and not 3.25%!

SCENARIO 2: Projected 3.25% return with annual withdrawal of $12,000

This policy also provides an option to cash out $12,000 per year for 10 years, from 56 years old to 65 years old.

Due to these withdrawals, less money would be invested in the participating funds and the returns will drop to 2.48% and the IRR table will look like this:

| Year | Date | Premium |

| 1 | 1-Jan-15 | 4488.6 |

| 2 | 1-Jan-16 | 4488.6 |

| 3 | 1-Jan-17 | 4488.6 |

| 4 | 1-Jan-18 | 4488.6 |

| 5 | 1-Jan-19 | 4488.6 |

| 6 | 1-Jan-20 | 4488.6 |

| 7 | 1-Jan-21 | 4488.6 |

| 8 | 1-Jan-22 | 4488.6 |

| 9 | 1-Jan-23 | 4488.6 |

| 10 | 1-Jan-24 | 4488.6 |

| 11 | 1-Jan-25 | 4488.6 |

| 12 | 1-Jan-26 | 4488.6 |

| 13 | 1-Jan-27 | 4488.6 |

| 14 | 1-Jan-28 | 4488.6 |

| 15 | 1-Jan-29 | 4488.6 |

| 16 | 1-Jan-30 | 4488.6 |

| 17 | 1-Jan-31 | 4488.6 |

| 18 | 1-Jan-32 | 4488.6 |

| 19 | 1-Jan-33 | 4488.6 |

| 25 | 1-Jan-39 | -12000 |

| 26 | 1-Jan-40 | -12000 |

| 27 | 1-Jan-41 | -12000 |

| 28 | 1-Jan-42 | -12000 |

| 29 | 1-Jan-43 | -12000 |

| 30 | 1-Jan-44 | -12000 |

| 31 | 1-Jan-45 | -12000 |

| 32 | 1-Jan-46 | -12000 |

| 33 | 1-Jan-47 | -12000 |

| 34 | 1-Jan-48 | -32,616 |

| Annual return: | 2.48% |

SCENARIO 3: projected 4.75% returns scenario

If we take the higher return for the non-guaranteed component, the estimated value of the policy would be $220,776.

| Year | Date | Premium |

| 1 | 1-Jan-15 | 4488.6 |

| 2 | 1-Jan-16 | 4488.6 |

| 3 | 1-Jan-17 | 4488.6 |

| 4 | 1-Jan-18 | 4488.6 |

| 5 | 1-Jan-19 | 4488.6 |

| 6 | 1-Jan-20 | 4488.6 |

| 7 | 1-Jan-21 | 4488.6 |

| 8 | 1-Jan-22 | 4488.6 |

| 9 | 1-Jan-23 | 4488.6 |

| 10 | 1-Jan-24 | 4488.6 |

| 11 | 1-Jan-25 | 4488.6 |

| 12 | 1-Jan-26 | 4488.6 |

| 13 | 1-Jan-27 | 4488.6 |

| 14 | 1-Jan-28 | 4488.6 |

| 15 | 1-Jan-29 | 4488.6 |

| 16 | 1-Jan-30 | 4488.6 |

| 17 | 1-Jan-31 | 4488.6 |

| 18 | 1-Jan-32 | 4488.6 |

| 19 | 1-Jan-33 | 4488.6 |

| 34 | 1-Jan-48 | -220,776 |

| Annual return: | 3.94% |

The actual return is 3.94% and not 4.75%.

I guess by now you should know how the table for IRR calculation is set up so I will skip the table for scenario 4. If you take the cash back option, the returns would drop to 3.77%.

Notes

- The actual returns vary by cases and it is not similar to what I have calculated here. You should run your own calculation to determine it. Let me know if you need help.

- This is a policy for 34 years and it is a long time. The policy returns are higher if the duration is longer. The above example will give a return ranging from 1%-3% if you take the surrender value at 20th year.

- It is important to consider the value at maturity and not take any value in the middle of the policy. This is to account for terminal bonuses at maturity and be fair to the insurance companies.

- Kyith has studied more examples on his blog.

Wait, there’s more

Louis has created an endowment returns calculator that will help you estimate the returns on your endowment plan. You can get it here: Dr Wealth Endowment Plan Returns calculator

He also broke down everything you need to know about Endowment Plans, read that before you commit to your next endowment plan.

The projected % return is on the non-guaranteed portion per your table unless somewhere else in your contract indicate the guaranteed portion, i did not see any misrepresentation. Not to forget there is insurance element that need to be included in our assessment, Btw I am wondering people who reached the end of policy, which spectrum ends mostly falls in on projected % return.

Hi Cory, I need to clarify. I did not say misrepresentation. I meant most people misinterpret the information.

Not everyone is like you who understands policies. This article aims to correct the wrong perception of expected returns from their policies.

I also commented about a similar subject on InvestmentMoats.

The Projected Investment Rate of Return (PIROR) actually refers to the par-fund return of the insurer NOT the policy holder. The actual yield for the policy holder can be found (not so obvious) as effective yield somewhere in the Benefit Illustration. As Alvin mentioned the XIRR is the right way to measure, especially when “cash-backs” are involved and a time value calculation is not possible.

Returns of endowment and whole life policies (participating) are based on contractual values: (1) $1 per $1,000 sum insured PLUS (2) compounding bonus (CRB) of 1%pa PLUS (3) loyalty bonuses at certain intervals PLUS (4) maturity bonus.

For the $1 per thousand sum insured and CRB, the contract value can be reduced subject to par-fund performance by the insurer. Example: $0.70 per $1,000 and 0.75% CRB, when times are bad. Prudent insurers practice “smoothing”, so that they can maintain the payout.

The 3.25% and 4.75% PIROR means to say:

“If the par-fund can achieve 4.75%pa average, we would honor the contract and not cut any bonus. If returns drop to 3.25%pa average, we could cut bonuses and you may end up with that amount”

Par fund returns are disclosed in the Product Summary of the product.

In extreme cases, insurers can also change the loyalty and maturity bonus (these bonuses account for a large portion of the total payout). Some insurers have cut these before, resulting in a VERY poor return for investors.

Only Tokio Marine Asia claims to have NEVER cut bonuses. NTUC is known to have high returns FOR older policies (not the newer ones).

{Disclosure: I’m a licensed Financial Adviser in a fee-based financial planning firm}

Thanks Brendan, your explanation added the professional touch to the article!

hi alvin,

thanks for your sharing.

i am Aviva- Save as Your Proctect policy holder.

i just get to know that the interest rate revised to 0.5% instead of 2.5% (as per benefit illustration) since year 2009.

when i refer back to the policy, that is a statement “the above non guaranteed illustration assumes the benefits are illustrated at an interest rate at 2.50%p.a”

Base on the Illustration (2.5%), actually i will get back $60k on mature date and i just wonder to know that shall i get back the same amount $60k after Aviva revised the interest rate to 0.5% in stead of 2.5%.

Please advise. thanks!

When the projection rate gets revised lower, your policy is likely to mature with lesser money. That’s the bad news 🙁

hi Alvin, i have an endowment policy which is 5 years premium term at $5000 per annum, and the policy term is 72 years. Upon maturity, i will be able to receive 37,456 guaranteed value and 122,850 non-guaranteed (at 3.25% projected investment return). i tried to calculate the IRR using your excel sheet by inputting the premium amount of $5000 for the first 5 years and the final amount of 37,456 (guaranteed) and 122,850 non-guaranteed into year 72. but the IRR calculation returns to an error.

May i know which part have i performed wrongly?

The common mistake is forgetting the negative sign in the final amount. You can try again.

The IRR I calculated ranged from 1% (guaranteed only) to 3% (guaranteed + non-guaranteed)

How do we calculate the IRR assuming that the illustration can only show option to cash out?

In MY, even if i do not cash out, the illustration presumes that it is on a cash out basis.

How can i calculate the IRR?

U still can use IRR with the only one cash out when the policy matures

hi, whats a good endowment/savings plan to start off for my daughter. She is 18 and will set aside $100 monthly. This would be part of her long term savings plan.

We would not be able to recommend any endowment products. You would have to look for a qualified and trusted financial advisor to help you with this.

Hi Alvin,

Great article!

What is the average amount of a matured endowment today ?

Is there a data resource you can point me to tor this kind of stuff ?

Thanks!

That’s a good data to have! But I do not know where to get it too 🙁