While most growth stocks have risen by about 50% since their lows back in early May, we have one company that is still lagging behind.

Trading at about 30% off its ATH and currently sitting in severely oversold territory, I believe that this stock should be in your watchlist.

ARK Invest believes it too as they have been adding to it almost everyday:

A recent IPO stock founded back in 2005, let’s take a look at UiPath (NYSE:PATH) and why I think that its price point at its present levels may be ripe for an entry.

Though technicals indicate the possible formation of a renewed rally, let us also take a chance to explore what UiPath actually does and how strong their fundamentals are compared to other fast-growing tech companies.

What is UiPath and what do they do?

At the very onset, we must be aware of what Robotic Process Automation (RPA) is.

I’m trying to avoid the use of technical jargons here but this is one which revolves around UiPath and what they do. In normal circumstances, technology develops fast but in times of crisis, technology develops even quicker.

Along with other disruptive themes such as 3D Printing, Genomics etc, RPA is now on the path to being the next big disruptive theme.

So, what is Robotic Process Automation?

Robotic process automation (RPA) is a software technology that makes it easy to build, deploy, and manage software robots that emulate humans actions interacting with digital systems and software. Just like people, software robots can do things like understand what’s on a screen, complete the right keystrokes, navigate systems, identify and extract data, and perform a wide range of defined actions.

But software robots can do it faster and more consistently than people, without the need to get up and stretch or take a coffee break.

What is robotic process automation? – uipath.com

You may be thinking, “what exactly are tasks that robots can help humans accomplish”? To explain this better, I’ll make reference to a case study on how UiPath’s technology helped “Ireland’s health system deal with the pandemic”.

In summary, this case study illustrates how the RPA software provided by UiPath assisted the health services ministry of Ireland (HSE) during the pandemic. Key examples as follows:

Problem Statement -Vetting Status of New Employees

“Everyone who comes to work for the HSE in certain roles, must be checked by the Irish police force, An Garda Siochána. It’s a process similar to a Criminal Records Bureau (CRB) check in the UK. It must be completed for anyone who might have access to, or contact with, children or vulnerable adults within their position.”

“It’s a vital, yet time-consuming role with about 20,000 checks being completed every year. Regulations are expected to tighten, meaning relevant employees will need to be re-checked every three years. The result is annual checks are predicted to increase to 60,000.”

“This called for a full-time robot assistant – and the team have affectionately named him Bertie. He’s now actually processing as many cases in one hour than we could previously in five days, and allows us to run the update weekly instead of monthly so increasing our efficiency and enabling hiring managers to get new recruits into post sooner.”

With the example above, RPA is about using robots to complete monotonous tasks such as vetting of employees, data entry, database collations etc.

While RPA is not a turn-key solution for every problem faced by organizations, it certainly does its job by further synergizing the relationship between the workforce and digitally-enabled technologies.

UiPath’s Business Fundamantals

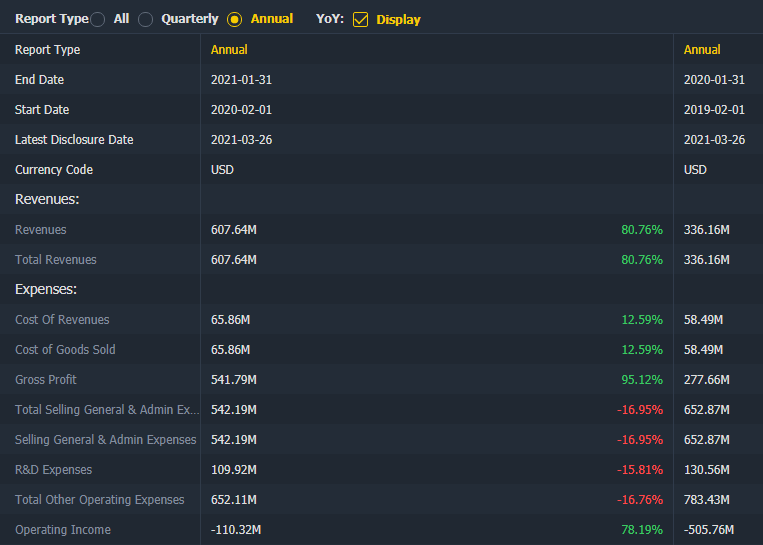

While the fundamentals for most IPO stocks are difficult to compare due to the lack of published financial statements, based on what is available, it looks like the losses are contracting for the company however they are not profitable at the time of writing.

With bottom-line net losses decreasing and total revenue increasing, this is definitely better than if the inverse were to be reported.

In terms of ratio comparisons with other peer group companies, UiPath is trading at approximately 30x C2022 sales, versus high growth peer group average of 26x, yet growing at the same level as the peer group average of about 31%.

Alvin had covered more in a previous video as well:

Technicals – Support holding strong at $65-70

The formation of the descending triangle was clear as Path was unable to break past their linear resistance level since hitting their ATH of $90.

Unfortunately, at the apex of the descending triangle, we see price action break below past its previous support at around $68.

In all honesty, I was caught in the false breakout where I saw price action breakout above the $70 level (Red Circle).

Given the increase in volume, oversold signs, and convergence of the MACD, it did seem right for an entry given the risk to reward at this point.

My Initial Thoughts on UiPath

In all honestly, when UiPath completed its IPO early this year, I did not pay much attention to it as my initial impressions were that it was just another tech company. I even associated it with Xiaomi at one point in time given the similarities in their logo.

I tend to avoid trading IPO stocks at their launch month as we really want to give the price action some time to breathe and let the market come to some form of acceptance on their price.

For UiPath, what has captured my attention is not so much their valuations or fundamentals but how the technicals indicate that support is robust at this crucial $70 price point.

What’s ahead for UiPath?

Moving forward, we see a new short-term support form at $66 where is where buyers previously bought up 4 days ago.

Based on the above chart analysis, I still think that we are at severely oversold levels here. Be in a short-term play or a longer-term one, this stock looks primed for a rebound in the coming weeks.

As always, there are dangers with such plays. We see previous support broken and there is no reason why the $66 support level cannot be broken as well. For those seeking shorter-term gains, do set your own trading rules to limit your loss of capital should the tides turn against you.

I am vested in the stock at the time of writing.