2021 was an absolute disaster for growth stocks. If you bought growth stocks this year and you’re still holding, chances are you’re very much in the red.

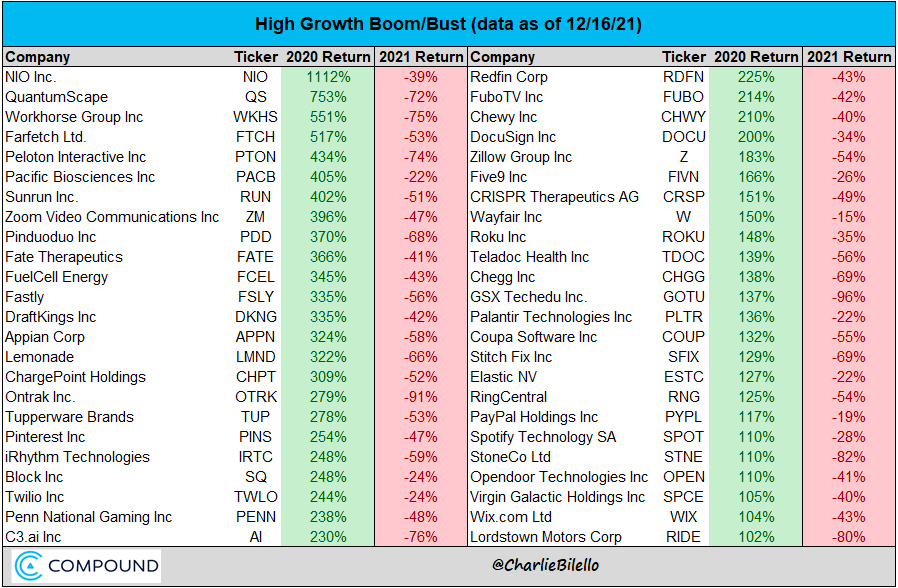

To put things into perspective, take a quick look at the chart below.

Most of us here would have gained with these stocks in 2020. However, stocks don’t go up forever. As such, 2021 became a profit-taking year for many.

At these levels, are we primed for a rebound, or will 2022 be the nail in the coffin for these companies?

In this article, we will focus on growth stocks – their current situation, the potential opportunities for 2022, risks, and some of my personal picks!

Overview – 2021 in hindsight

If we look at things from a broad overview, the optimism in the market early this year was indeed hasty. A correction was most certainly inevitable. As such, the bull rally for growth stocks started to slow in March. By May, most had already fallen by almost 40-50%.

At this point, I started a position in some of the stocks above, given the fairly ‘neutral’ risk-to-reward ratio. Clearly, things did not rebound from there. In fact, for the most part, growth stocks are testing even lower lows at present.

Many would know that the root cause of this is inflation. But, on its own, inflation can only do so much. We only feel the full effect of inflation on growth stocks when combined with other factors such as supply chain issues, sector rotation, and monetary/fiscal policy changes.

Supply Chain Issues

- Global Chip Shortages – Causes an increase in production costs for many growth companies. This can lead to a decrease in the already non-existent margins.

- Suez Canal incident – Caused a ripple effect for other ships stuck in the bottleneck. It also added another layer of complexity to the already-stretched supply chain of young growth companies.

Sector Rotation

- The bull run for growth stocks resulted in the sector being overbought. Hence, investors look for safety in other sectors such as utilities, FAANG, tech-large cap, etc. You may refer to the diagram below showing ARKK vs. MSFT.

- Inflation eats less into the bottomline of companies with LARGER profit margins. This usually includes value stocks or stocks that are more established.

Changes in FED – Monetary Policy

- An easy money, low interest-rate environment will not last forever.

- High interest rates hurt aggressive growth stocks when their valuations are calculated via the Discounted Cash Flow method.

- “Transitory” inflation is not turning out as expected. Inflation is here to stay.

Opportunities for Growth Stocks in 2022

All this begs the question, is the worst behind us or are we just getting started?

In all honesty, your guess is as good as mine. No one can predict where the stock market will go in the short term. But, to this end, I would like to bring your attention to an article from ARKK Invest.

The Value of Innovation Stocks

To save you the 24-minute read, here are five key takeaways from this article:

- Know your investing time horizon.

- Observe the divergence between the price performance of SOME growth stocks and their sales.

- Stocks associated with “staying at home” have now transformed. Businesses have come to require their products/services in order to “stay connected and competitive.”

- Many growth stocks sacrifice short term profitability to “capitalise on an innovation age; the likes of which the world has never witnessed.”

- “With a five-year investment time horizon, our forecasts for these platforms suggest that our strategies today could deliver a 30-40% compound annual rate of return during the next five years.”

Interpreting the Valuations

Of the five points mentioned, I think that number five should be of most interest to us. To put it bluntly, anyone can tell you that XYZ investment will perform XXX% in 5 years. You can even find Youtubers with 10 followers who make such bold statements.

What’s different here is that ARK has indeed lived up to their claims. Some may argue that their correct valuation for Tesla was a one-hit wonder. However, I dare argue that they have scored far more than just one ‘one-hit-wonder.’

I might be buying into wishful thinking here. Still, doing so when most growth stocks are about 40% to 50% down from their all-time highs makes the risk-to-reward ratio a bit more skewed to my advantage.

What do the charts say? Pain or Gain?

I’ve decided to use ARK Innovation ETF (ARKK) as a reference. To simplify the volatility, I used the weekly candlesticks instead of the daily.

It’s already interesting to note that we are approximately 40% off our highs. Still, there is also the fact that we are now in the oversold territory, with the RSI currently sitting at 32. Oversold signals are generally considered to be favorable points of entry.

“Fundamentally oversold stocks (or any asset) are those that investors feel are trading below their true value. This could be the result of bad news regarding the company in question, a poor outlook for the company going forward, an out of favor industry, or a sagging overall market.”

Source: Investopedia – Oversold

For those seeking a good entry point, note that that there is a chance that the ETF can reach SEVERELY oversold territory. This is when the RSI goes below 30.

Although this only happened to ARKK once, back in 2016, who is to say it will or won’t happen again? Nonetheless, caution is advised, given that the MACD is still trending down sharply.

What should I do with my growth stocks in 2022?

Personally, I’m really selective with growth stocks. As much as possible, I avoid companies that do not generate profit.

Unfortunately, I do have some trades in the red at the moment. However, they don’t bother me. In times like this, I’m quite certain that I’ll be holding on to these positions for the next 2-3 years.

Meanwhile, we can DEFINITELY expect to see inflation in 2022, as revealed in the latest FOMC meeting. The only saving grace in this is that investors can stop speculating as the figures are now clear.

By addressing the topic of inflation, I feel that the market can have a sense of certainty as all parties involved now know what to expect. Given how markets are always forward-thinking, we may very much be in a situation where inflation is priced in.

What are your thoughts on US growth stocks as we go into 2022? Share your opinion in the comments section below!

P.S. while the general growth stock markets was lacklustre, Cheng’s portfolio clock a return of +32% as of end Nov 2021. He shares how he seeks out winning growth stocks to build a portfolio that can outperform the markets at his live webinar, stay tuned for the next session here.