- The HKD has been pegged to the USD since 1983. Recent speculative activity has threatened to upend the peg.

- We examine the mechanics behind the peg and Hong Kong’s place in the battle of supremacy between the US and China.

- Hong Kong stock investors will do well to stay calm and keep faith with the currency.

1992 – London

George Soros holds a PhD in Philosophy from the London School of Economics, has published numerous books, ran a hedge fund, and is now actively spending his billions on philanthropy and political activism. Yet, despite all the things that he has achieved, most people would know of him as the man who broke the Bank of England.

Prior to the establishment of the European Union and the Euro, European countries abided by European Exchange Rate Mechanism (ERM). Countries in the ERM agreed to peg their currencies against the German Deutschmarks, building in a 6% buffer to allow for the usual fluctuations.

With the peg, Central Bankers have the responsibility of maintaining their currencies within the acceptable band. When their currency strengthens or weakens to test the band, they are obliged to intervene. Central banks typically do one of two things, either buying or selling the currency, or by adjusting the interest rates, in order to ensure that it fluctuates within the predetermined band.

In 1990, against the backdrop of high unemployment and a sputtering economy, the UK joined the ERM. The peg was set at 2.95DM to one British pound, with the band fixed at 2.78 to 3.13 marks. By the spring of 1992, cracks were beginning to show in the system. Unlike the UK, Germany was enjoying a period of technological advancement and growth; their economy has done well and this was reflected in the strength of the currency.

In the market place, investors and traders sell the weaker currency to buy the stronger one. The British pound started trading at the lower end of the band. It was wrongly priced from day 1 and the only thing that prevented the pound from dipping below 2.78 DM is the British Government’s guarantee that it would abide by the covenants of the ERM and keep the pound propped up. With crisis looming, UK Prime Minister John Major increased interest rates to 10% in a bid to stem the currency outflow.

Across the Atlantic Ocean, Soros and the Quantum Fund he manages has built up a $1.5B short position in the British pound. Following an interview with the President of the German Bundesbank, who suggested that the currency could come under pressure and might even be devalued, Soros made the decision to go for the jugular.

When markets opened in London on the 16th September 1992, Soros started selling all the pounds he could lay his hands on, increasing his position to $10B at one point in time. Other traders also caught on. They smelt blood and joined him in shorting the pound.

On the other end of the trade, it was a mad scramble to defend the pound. Just the day before, the Central Bank of England had pledged to spend up to $15B to defend the peg. Before 9am, they had bought 1B pounds, with nary an effect on the currency. By 11am, the UK announced that it would increase its interest rates by an unprecedented 200 basis points to 12% to protect the pound.

Yet, the pound continued to plummet. To the extent that the Central Bank had to make yet another announcement later in the afternoon to raise the interest rate to 15%, in the hope that the slide would be reversed and speculators thwarted. By 730pm, the battle was lost. British Finance Minister Norman Lamont, in an impromptu press conference, announced that Britain would exiting from the ERM and allowing the pound to float freely in the market.

Overnight, Soros became $1.4B richer. All in all, the defence of the pound was estimated to have cost British taxpayers 3.3B pounds.

2019 – Hong Kong

Like the Greek Sirens who lured unsuspecting sailors with their enchanting songs, currency pegs have taken numerous casualties quietly over the years.

Emboldened by Soros’s heist of the pound and the rich pickings a currency devaluation would offer, many fund managers, investors and traders have clamoured to be on that side of the trade. They pile their bets into currency pairs as soon as some form of weakness appears.

The success stories were broadcasted far and wide, and fund managers like Soros became the modern day Ulysses, beating all odds to sail home safely and emerge triumphant. The losers on the other hand, quietly slinked away, often never to be seen or heard again. More often than not their vessel end up shipwrecked along the rocky coast of the Siren Islands.

The most recent of which is Kyle Bass.

An American hedge fund manager who had some small success with the subprime crisis in 2008, Bass has been a perpetual bear, a far Right proponent who appears on TV regularly with former Trump advisor Steve Bannon, and massive critic of anything China.

His bearishness has been evident for a good part of the previous decade, having constantly put out calls for the yuan’s imminent devaluation. The Chinese economy’s continued upward trajectory has anything but fuelled his self-styled mission.

Hong Kong Protest

In Feb 2019, the Chinese government proposed an Extradition Bill to be introduced in the Hong Kong SAR. By now, we know that the bill marked the start of mass protests in the territory, with millions of citizens taking to the streets in what was initially a powerful yet peaceful show of force that eventually descended into violence. At that point in time though, it was still a murmuring rumble only audible to the keenest followers of Sino-Hong Kong affairs.

What was for sure then was that the HKD has been weak. In fact, it has been weak for pretty much for the whole of 2018, tethering around right at its limit for much of the year. The HKMA has intervened on multiple occasions to prop up the currency. It was time for the opportunist to strike.

On 14th Apr 2019, Bass published a letter to subscribers of his fund titled “The Quiet Panic in Hong Kong”. It was his first letter in more than three years, and he compared Hong Kong with Iceland, Ireland and Cyprus, where banking crisis has crippled the economy and led to massive default.

The main thrust of the letter lies in attacking the HKD USD peg. In it Bass makes the assertion that all pegs will eventually fail, and the time has come for the HKD peg to breath its last breathe. Bass urges his readers –

The divergence between the economic cycles of US, China and Hong Kong will ultimately tear the currency board apart. If you are currently a saver with your savings or investments dominated in HKD, why on earth would you not convert to USD and earn an extra return while also avoiding a catastrophic devaluation?

The letter was fat on rhetoric but thin on logic. Even the armchair economist in me could see that Bass was skating on thin ice. While it was true that the HKMA had to step in to purchase the HKD on a number of occasions in 2018 and 2019, they remained well capitalised. On top of that, HKD interest rates were below one percent then, and that allowed the HKMA a lot of leeway to manoeuvre.

Nevertheless, in no time the western media picked it up and made a big song and dance about how the peg is about to be undone.

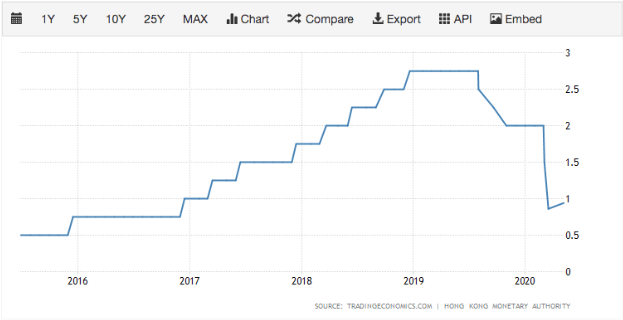

During this time, the interest rates slowly and surely crept up. It started from a low base of 0.5% in 2016 and reached 2.75% at the end of 2019. This alleviated the outflow of funds and the HKD strengthened significantly.

Perhaps it was because Bass did not have the stature nor the capital of Soros at his disposal. Perhaps it was because London in 1992 was a very different place from Hong Kong in 2019. The former had to contend with chronic economic issues, while for the latter it was an acute and unresolved geopolitical situation. Perhaps COVID-19 hit and put a temporarily end to the violence that would most otherwise continue. Most likely it is a combination of them all, and more.

Whatever the exact reason was, Bass did not get what he had come for. His ship ran aground and he was lucky to have survived.

Exchange Rate Pegs

Most reading this should be familiar with exchange rates dynamics; they should require little introduction. (But I am going to give you one anyway)

Say we were to travel to Japan for a holiday. Before the trip, we visit our neighbourhood money changer to purchase Japanese Yen. In doing so, we are actually selling our Singapore Dollar. The current SGD-JPY exchange rate is approximately 76.5, so selling one Singapore dollar would yield 76.5 Japanese yen.

The same for purchasing a Japanese car. Toyota builds their cars in Japan. They use the Yen to pay their workers and to keep the factory running. Naturally the sales proceeds will eventually end up being converted to JPY.

Interest rates also play an extremely important role in currency flows. If Yen dominated interest rates are higher than that of SGD (Just saying. It isn’t. Yen rates have been negative for years.), savers may decide that it is more worthwhile to move their SGD bank deposits into Yen to earn the higher interest. Again, this involves selling SGD and buying Yen.

The stronger the economy, the more valuable the exports, the higher the interest rates, the greater the demand for the currency. Greater demand will lead to an increase in price – the currency strengthens.

Of course the converse is true. With a faltering economy, exports that are of little value, and few people wanting to visit the country for tourism, there will be little demand for the currency. This will lead to an inevitable weakening of the currency, and invite the interest of speculators like Soros and Bass.

Impossible Trinity

In economic decision making theory, management of currency has always been called a trilemma. Economies have to grapple with three issues when it comes to managing their currencies – capital flow, monetary policy (interest rates) and fixed exchange rates. The issues are elegantly represented on the following triangle.

Academically speaking, only one side of the triangle is achievable at any given time.

The first way to do so would be via capital controls. By controlling the flow of capital, an economy is able to keep a lid on its currency fluctuations. The clearest example of this would be China (Side C). Unfortunately this would result in a closed economy – hardly an acceptable option for many smaller economies.

Much of the world operates along Side B. There is little capital control, Central Banks run their monetary policy independently, and there is no fixed exchange rate between its currency vis a vis other countries. Australia, for example abolished their peg against the US dollar in 1983.

If the aim is to build an open economy with a free flow of capital and a pegged exchange rate (Side A), then the country at some point in time must mirror the interest rates of its currency peg. Failing to do so would cause currency arbitrage, which is a great stressor on the peg.

Yet, allowing currencies to float freely without any guidance at all is also not a desirable outcome. Trade partners need to know that the currency will hold its value. Citizens and even expatriates need assurances that their earning powers will not diminish overnight.

Despite the hazards associated with currency pegs, many countries have nevertheless tried to make it work. The United Kingdom, courtesy of Soros, found out the hard way. The Argentinian peso also had a brief dalliance with the US dollar many years ago.

Closer to home, the SGD is pegged to a basket of foreign currency and the band (The call it the S$NEER – Singapore Dollar Nominated Effective Exchange Rate, likely a perverse snub at naysayers) is monitored closely by the MAS. The basket is never announced, while the range and the slope changes according to economic conditions. We are essentially operating a soft peg.

The HKD on the other hand is a hard peg, with thresholds fixed and made public. The Hong Kong Monetary Association (HKMA) serves as the governing authority to keep the HKD trading between 7.75 HKD to 7.85 HKD to 1 USD. Whenever the HKD tests the weaker end of the band at 7.85, the HKMA would intervene, exchanging their stash of USD for HKD and in the process propping up the currency.

When the HKD becomes stronger, the opposite occurs. HKD would be sold and USD purchased. This serves as a pressure relief valve and allows the HKD to cool off.

2020 – Washington DC, Beijing.

COVID-19 has hit the US hard. At this moment, the country has reported more than 2 million cases with more than 100 thousand deaths. This is three times more than Brazil, which at seven hundred thousand infections, is the second most infected country in the world.

Faced with a growing death toll, economic fallout from the sustained lockdown across the country, escalating unrest all over the country against the death of George Floyd and a Presidential Election in five months’ time, President Trump has been scrambling to defend his decisions and administrations in the way he knows best – picking fights.

In recent weeks he has been harping on Obamagate, a nebulous crime the previous President has apparently committed but which he is unable to name. He has also voiced displeasure with and then made the decision to pull out of the World Health Organisation. And then there is his usual skirmishes with reporters and the news networks. In recent times however, Trump has directed his best efforts at China.

While the animosity is nothing new, the attacks have intensified. Trump has been calling COVID-19 the Wuhan virus and the Chinese virus for the longest time. He was also reportedly considering revoking the visa of all Chinese students in the US, a move that will affect more than 270 thousand students. In addition, a bill named the “Holding Foreign Companies Accountable Act” is being passed. The Act will require foreign companies listed in the US to be subjected to additional audits by United States based auditors. On top of that, all companies must also make a declaration that they are not under the control of foreign governments. Pundits have pointed out that this could potentially lead to the delisting of many Chinese firms on American bourses.

There is logic in Trump’s ways. By whipping up a nationalistic frenzy, he is able to divert attention from domestic issues in his own backyard.

Beijing on the other hand, has also been kept busy passing laws. On the 22nd of May, a new resolution was put forward at the National People’s Congress. The new law is intended to prevent, stop and punish acts in Hong Kong that threaten National Security.

This act has many implications. First of all, Beijing has opted to bypass the SAR’s lawmaking body the Legislative Council and have the law take effect automatically. Secondly, there is the question of enforcement. For the law to be properly enforced, it would imply that mainland agencies would have control over certain aspects of Hong Kong governance. There is the overriding concern that Beijing would use the law as a blanket to clamp down on dissidents. Needless to say, the weekend the law was floated, thousands of protesters ignored social distancing regulations to join in another round of protest.

US Secretary of State Mike Pompeo was one of the first to condemn the proposed law, warning that it would be a death knell for Hong Kong’s “One Country, Two Systems” mode of governance. He further added that the US will be considering withdrawing trade privileges as Hong Kong can no longer be considered as autonomous.

It was 1841 when Hong Kong was first ceded to the British in the First Opium War. Now, 180 years on, Hong Kong finds herself once again in the crosshairs of another two global super powers as they do battle for supremacy.

2020 – Hong Kong

Two days ago on the 9th June 2020, Bloomberg reported that Kyle Bass is launching yet another assault on the HKD. He is raising money for his strategy that will use option contracts leveraged at 200x. Investors can expect to profit handsomely should the peg break down in 18 months, failing which they stand to lose their entire investment.

Yet, the Hong Kong of 2020 is very different from the Hong Kong of 2019. For one, the full force of Hong Kongers’ emotions, as manifested in the protests, seems to have subsided. The city is one built on pragmatism, and pragmatism will soon dictate that most Hong Kong residents drop their ideals for normalcy and stability. Especially when they realise that no one else but China can provide that continued level of prosperity to Hong Kong.

The HKD has also seen an about turn. Instead of trading weakly at 7.85 as it has when Bass launched his initial attack, the HKD is now bursting at the seams and has been plastered to the stronger limit of 7.75 for the past three months.

Mainland money has been flowing into the Hong Kong’s stock market through exchange links with Shanghai and Shenzhen. Eligible mainland investors (defined as institutions and individuals with at least five hundred thousand yuan in their trading accounts) have been net buyers of Hong Kong stocks for the past 35 weeks.

A significant amount of demand for HKD arose from mainland companies raising funds in the SAR. In the midst of the protests, Alibaba pulled off the largest IPO of last year in Hong Kong, raising $11.2 billion for their secondary listing. Other mainland behemoths Baidu, Netease and JD, all of which are traded in the US, are also said to be considering a secondary listing in the territory.

The influx of capital has increased the demand for HKD. The carry trade, traders borrowing USD and parking the funds in HKD to take advantage of the interest rate differential, is now working in Hong Kong’s favour. The HKMA, instead of having to buy HKD to prop it up, had to sell HKD in the markets. Just this year alone the HKMA has sold over $48 billion worth of Hong Kong dollars.

Trump’s “Holding Foreign Companies Accountable Act” will inevitably benefit Hong Kong as mainland Chinese companies eliminate the option of listing on American platforms and turn much closer to home.

Rather than keeping Hong Kong close, American policies have in fact pushed Hong Kong further away. China’s moves, despite sparking off protests and bloodshed, have pulled Hong Kong closer into its sphere of influence.

No Reason to Panic in Hong Kong

We have been keeping close tabs on the HKD peg for a while now. The Dr Wealth portfolio carries a fair bit of exposure on the Hong Kong Stock Exchange. We are constantly thinking of how to protect our investment.

Would unpegging of the HKD cause much turmoil to Hong Kong market? Should the retail investor be worried? Should they bail out, cash out and give up on HKSE altogether?

To take it one step further, how can we profit if the peg is really removed? Should we short the HKD? Would there be arbitrage opportunities on the currency or even shares with dual listings in Hong Kong and other markets?

The Peg has been in place since 1983. Matured, mellow and approaching middle age, it remains rock solid. The recent events have shown up the peg’s resilience.

If for any reason the currencies are indeed delinked in the near future, it will be highly unlikely due to speculative activity.

The peg remains a symbolic umbilical cord that ties Hong Kong to the free West, and removing that link will enable the motherland the chance to make a strong political statement. Should that happen, the transition will be carefully staged and managed. Speculators would do well to keep the old adage in mind and never get involved in a land war in Asia. It is our strong belief (loosely held), that the HKD peg will not cause distress for stock investors in the Hong Kong market. We will instead be stocking up on popcorn as we watch from the sidelines Kyle Bass and his entertaining antics.

Interesting and insightful analysis. Well done!!