The title sounds like a conspiracy theory whereby there’s a supreme force shaping the world order. While it is a bold statement, the reality is not far from it.

Romance of the Three Kingdoms: S&P Dow Jones, MSCI and FTSE Russell

Indexes track a basket of securities with the purpose of reporting the overall performances. For example, there are over 700 stocks listed in Singapore and it is difficult to track every single one to get a feel whether the overall market is up or down. That’s where an index comes into play, using a set of rules (usually a mathematical formula), to determine what securities go inside the basket. The FTSE Straits Times Index (FTSE STI) decided that the top 30 stocks by traded market capitalisation would be the basket as they represent more than 50% of the entire size of the Singapore stock market. The component stocks will be recalculated, re-ranked and revised routinely. If FTSE STI is up by 1%, we take it as the overall Singapore stock market is up.

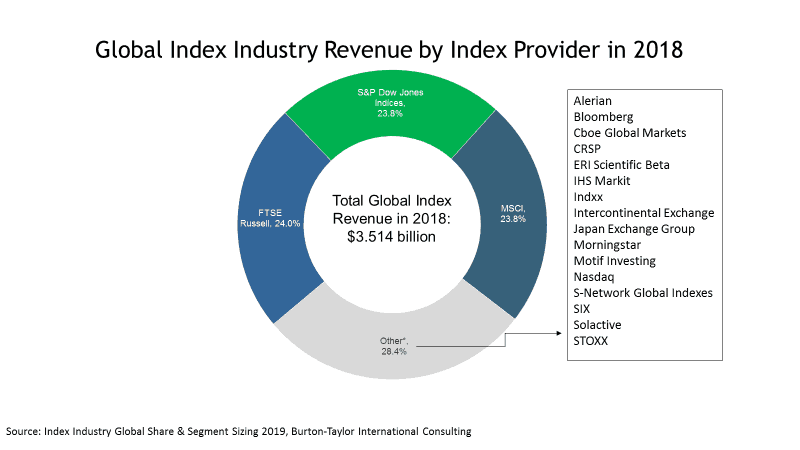

There are 3 major index providers. S&P Dow Jones, MSCI and FTSE Russell. Their combined market share represents 71.6% of the global index revenue in 2018. It is an oligopoly.

Their influence is omni-present. If someone asks you about how the U.S. stocks are doing, you would probably check out S&P 500. The active fund managers usually compare their performances against MSCI indexes. And in Singapore, we use FTSE indexes, such as the FTSE STI.

These indexes have already captured the mindshare of investors and formed a formidable moat – it isn’t easy to create new indexes to replace them. Try creating something to beat S&P 500. Tough luck.

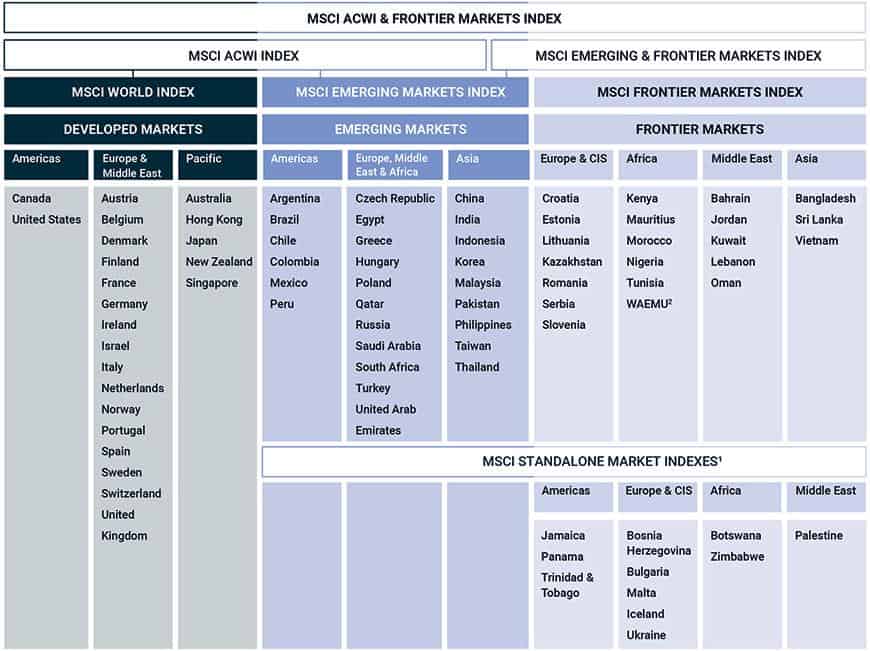

MSCI decided to structure the world of capital markets according to the image below… and the world follows. S&P Dow Jones and FTSE Russell have their own versions too.

How Index Providers Make Money

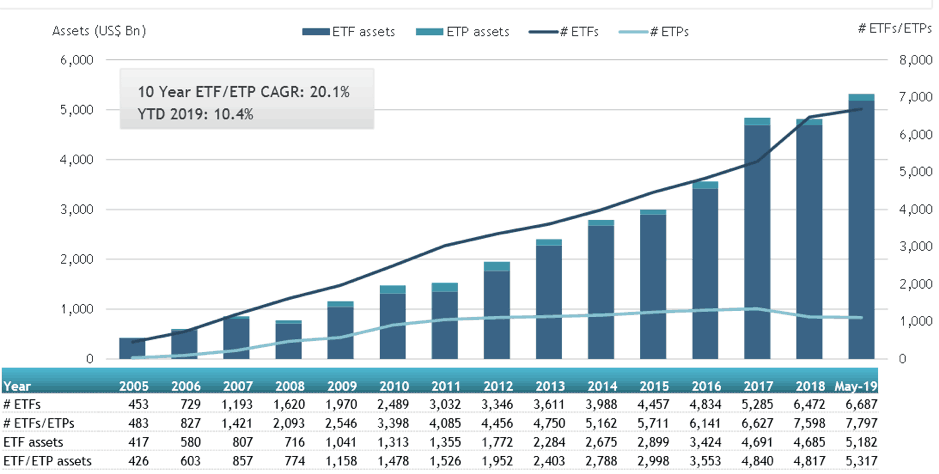

Index providers make money by licensing their indexes to investment firms to create products such as the Exchange Traded Funds (ETFs). ETFs are passive investment vehicles as the fund manager doesn’t decide what to invest in, except to dutifully follow the securities determined by the indexes. The rise in ETF popularity means indexes are playing an ever more important role in asset management. The Assets Under Management in ETFs (AUM, a.k.a. fund size) has been growing at 20.1% and is near $7 trillion as of 2019. Even large pension funds are allocating to ETFs increasingly.

Some figures here to let you have a sense of their scale and influence:

MSCI has $12.3 trillion assets under management benchmarked to MSCI indexes (not just ETFs, includes active funds). Over 1,200 equity ETFs were based on MSCI indexes.

S&P Dow Jones has $11.7 trillion assets under management benchmarked and indexed to their indices.

$15 trillion in global assets under management are benchmarked to FTSE Russell indexes.

Index providers have tremendous power because their methodologies would determine which stocks would end up in the indexes and at what weightage. For example, MSCI announced in 2018 that they are going to add China A shares into the emerging market index. This would mean that capital will start going after the A shares since ETFs will have to follow as long as they are tracking the index.

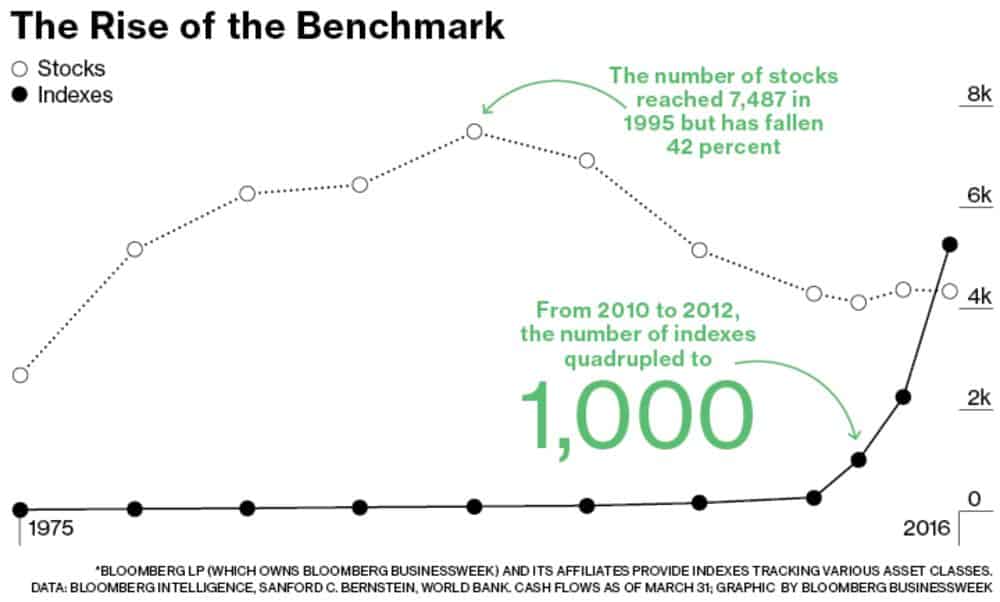

Constructing indexes has become a gold rush activity, which made it so ridiculous when in 2017, Bloomberg reported that there were more indexes than stocks in the world.

Investing in Index Providers

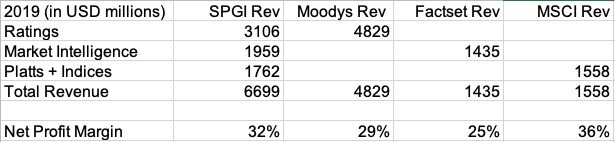

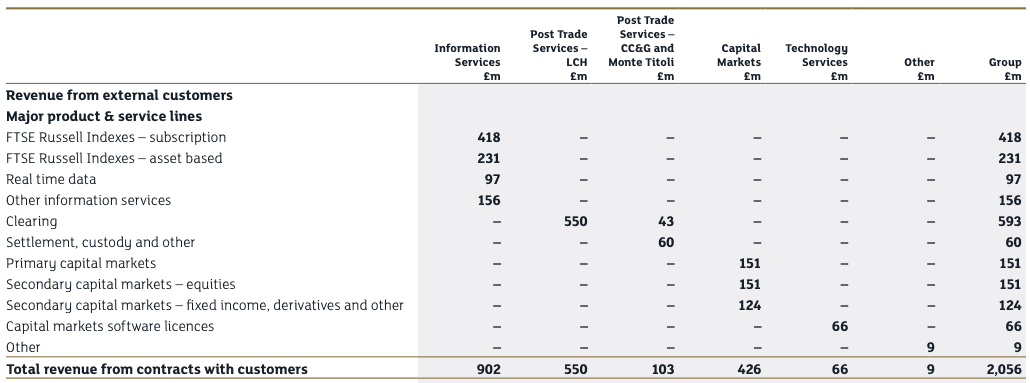

The good news is that you can invest in S&P Global, MSCI and LSE to get a piece of the index business. However, indexes are not the majority revenue contributor for S&P Global and LSE. The former has a credit rating agency competing with Moody’s and Fitch and a financial data service S&P Capital IQ competing with Bloomberg, Refinitiv and Factset. LSE has the exchange business.

S&P Global derived 26% of their revenue from the indices business (I added S&P Platts since it indexes the commodities market).

LSE Group derived about 32% of their revenue from FTSE Russell:

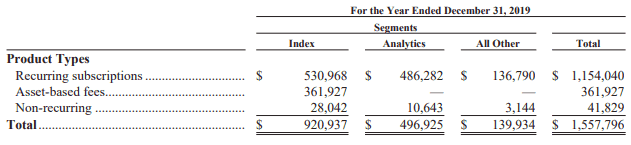

MSCI is closer to a pure index play, with 59% of the revenue from the index business.

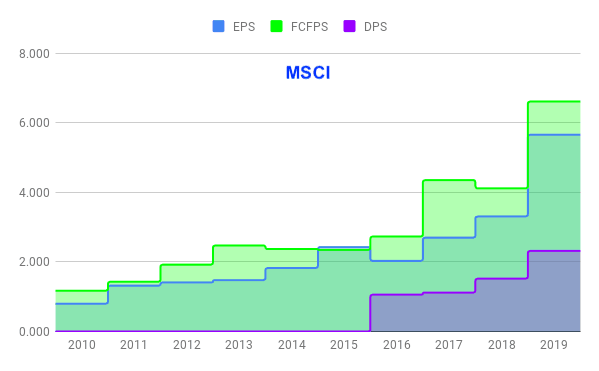

Indexing is a highly profitable business, which is evident in MSCI’s 36% net profit margin in 2019. Not only that, MSCI has grown their earnings per share by an average of 26% per year in the past 10 years.

I believe the three companies will continue to grow given that the ETF AUM is still growing strongly. There are talks about ETFs creating their own indices instead of paying royalties to these companies. There are also smaller players trying to vie for a share in the market. I believe their moats are pretty strong and not easy for any company to come up with new indexes to replace them.

In fact, I believe the 3 players will gain more market share in years to come, especially through acquisitions of smaller players. London Stock Exchange (LSE) owns FTSE and bought over Russell in 2014. And subsequently in 2017, LSE acquired Citi’s Yield Book and Fixed Income Indexes which adds more market clout to FTSE Russell. S&P Dow Jones was a joint venture between S&P Global and two other parties. This move combined two well-known index providers to amass a bigger market share. Hence this space should consolidate further with the smaller players being acquired by the big 3.

Conclusion

Indexes play a crucial role in providing a structure in the financial markets. Financial institutions and asset management companies will look to the indexes to determine where they would invest their money. ETFs rely on these indexes heavily. These are trillions of dollars that we are talking about. Any changes to the index composition would cause capital inflows and outflows in certain securities.

The indexes market is an oligopoly with S&P Dow Jones, MSCI and FTSE Russell as the major players. Indexes are a high margin business and we can get a piece of it since their parent companies are listed. I also expect these 3 companies to grow their businesses in years to come.

Have a look and tell me what you think.