Beginners who have invested

You knew this day will come. But you never really know how bad it feels until it happens – seeing your money vanishing fast with indecisions racing through your head. “Should I sell? What if it rebounds? What if it goes down more? If I sell now I will lose a lot of money!” Indecisions led to inaction. But the bad feeling doesn’t diminish.

You start to accept that investing is so difficult and there’s an urge to give up altogether. “I should just put my money in a savings account, and work my ass off for the rest of life. At least my money would still be intact. Why invest at all if I have to lose money.”

Your ego may be bruised, thinking that you are not cut out to be an investor. “Maybe I am not as good as I thought I was. Why didn’t I foresee the crash and sell before it happens? My friend did it and he must be a better investor than I am. I’m so pathetic.”

But your ego will regain its power and cause you to redirect your frustrations externally. You start to feel unfair as you take a step back from the crazy markets. “Why am I being punished for investing? I did my part but why do I have to suffer the losses while my peers who have not invested were not punished? Why is this so unfair?”

While you are redirecting blame, you might go even more cynical to say the entire market is rigged. “It is just legal daylight robbery of the masses.” Blaming someone or something always makes you feel better about yourself and the situation at hand.

Anyway you still have a job. The economy may slow but it is still humming along fine. It is not the end of the world. The investors in the markets are over-exaggerating and it doesn’t mean you need to agree and join the mania.

This is part and parcel of investing and experiencing it the first time can be overwhelming. What doesn’t kill you will make you stronger. Don’t resent the market. You will learn a lot about yourself – how you handle investment setbacks, volatility and losses. You have a long horizon ahead of you. Keep investing and you will mature as an investor. Don’t waste this experience.

Beginners who are about to invest

This is a good time to start! Your timing is immaculate. Don’t waste the opportunity. You should be one of the happiest to have escaped the crashing stock market.

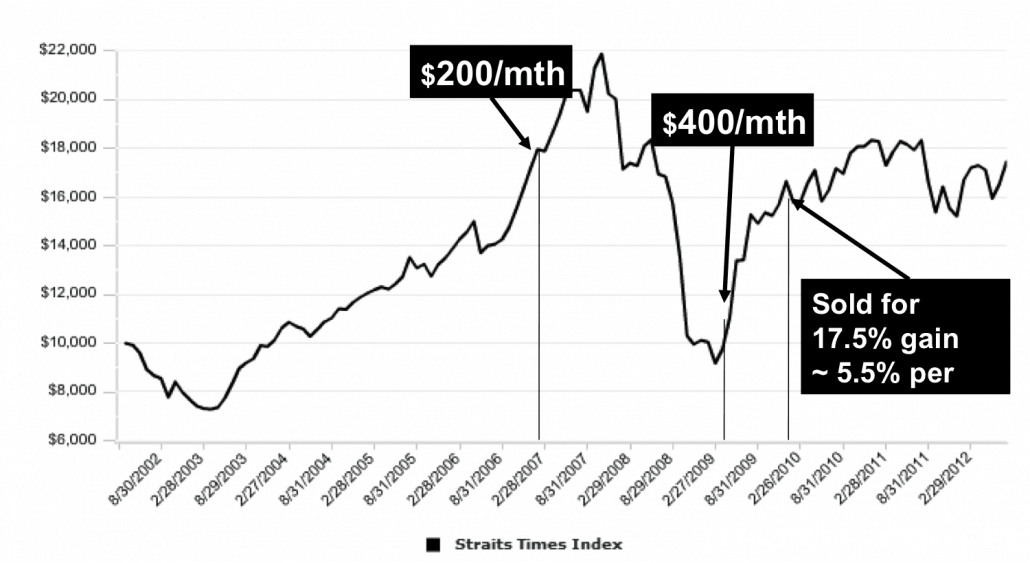

But just don’t show hand all your capital now. We do not know how low the market could go or when would it rebound. It is more prudent to diversify by time, or so called dollar cost averaging, and buy stocks periodically.

It would help you buy more stocks and lower your average prices as the market goes lower. That was what I did in the last financial crisis in 2008 where I invested throughout the crisis and despite investing near the peak, I came out of the crisis with a 17.5% gain. So you will be alright.

ETF Investors

You must be feeling sad seeing your stock ETFs taking big hits. You thought that being diversified into many stocks should be safer but the entire stock market got whacked and you still suffered as much as someone who pick stocks.

But don’t miss the forest for the trees. You are supposed to have both stocks and bonds in your portfolio unless you didn’t. Based on Modern Portfolio Theory, your bonds should have increased in value while your stocks have declined. If so, this is the time not to be spooked but to stay invested and do the most important thing – rebalance your portfolio by selling bonds and buying stocks.

You will do fine.

Investors who are retiring

I feel most sorry for you. This is a bad timing to retire and live off your investments. The worst is that this isn’t your fault but you are a victim. Selling your stocks now and losing a big chunk of your retirement funds is unthinkable and undoable.

You start to worry about whether you have enough for retirement. “Would I have enough to eat? I don’t want to burden my children. Maybe I should live simply and do some part time work for income.”

We humans are very resilient. We will always find ways to survive. It isn’t easy but we will find a way.

Maybe this is a time to really do proper financial planning. You must have some assets beyond stocks that you can move around and utilise. I suspect this because most Singaporeans aren’t big time stock investors. Below is the chart showing the breakdown Singaporean assets:

Singaporeans only have about 4% of their assets in stocks on the average. Of course, some of you might have a higher percentage but it would not be a big chunk. You still have your cash, CPF, life insurance and property. In other words, your wealth is pretty intact after all! Just take look at your big picture wealth and it might not be as bad as you think it is.

It might also not be a bad thing to take up some part time work. It would keep you engaged and being able to meet people. You might even enjoy it than to laze around all day.

Seasoned Investors

You have seen and experienced this before. You are used to volatility and this should not scare you. Yes, you might still feel some uneasiness but it should not be too hard to focus your attention elsewhere. Take a break. Stop looking at the markets. Watch a show. Go for a walk. Meet an old friend.

You probably have a watchlist already. But it is time to update it as markets are making record lows every day. Maybe you can find something better than what your current list have. When the time is right, you can pick up these fabulous stocks at ridiculously cheap prices. You know the drill.

You are the group that I am least worried about.

Day Traders

You must be loving it now because the markets are volatile. While investors hate volatility, you salivate in it. This is your time to shine and make more money per day than any other days before.

That said, it isn’t an easy game especially with more high frequency traders nowadays. Trading very short timeframe has little edge now. I only know a handful who were able to still win in this game. He and him.

We have a staff who is into short-term trading and recently she didn’t trade despite the volatility. She told me because the stops were too wide and she wasn’t comfortable to take the risk in case she get stopped out.

So don’t forget your risk management while you try to cash in on the volatility!

Trend Followers

You had a good run especially if you have been implementing trend following on U.S. stocks. The trend is your friend. You might still feel upset as a sizeable amount of paper profits vanished as prices retreated and came near to your stop orders.

This is not a time to think about profits but to take care of the downside. Make sure your stop orders are in place. And don’t take them away just because you don’t want to recognise your losses and want trade in revenge. The market doesn’t care and can be very cruel by going against your position more than what you can think is possible. You might get margin call from your broker if you have taken leverage. So please follow your cut loss rules!

Short Sellers

This is the time you have been waiting for. You might have been shorting the markets on previous occasions to no avail. But recently you have been proven right big time! Now you are on a roll and identifying weaker stocks to short.

You will be gloating at those long-only investors and really appreciate your nimbleness in going either directions as the market moves.

The only thing you should be concerned about is that market rebounds can be very strong too. Your risk management must be in place and get out of your short positions when the market turns. You don’t want your gains to be wiped out by a big rebound.

I was shorting the 2008 bear market with CFDs and had rather good success. But I totally missed out on the long side when it rebounded strongly since Mar 2009. I was too biased on the short side that I blindsided myself. Make sure it doesn’t happen to you if you want to trade both directions.

Conclusion

I tried to cover as many types of investors and traders but I believe there are many more whom I didn’t manage to capture.

Most importantly I think you should be able to resonate with some of the things I have shared. I am human and have experienced a lot of these emotions and feelings too. It is normal and don’t take it too hard on yourself.

Another important aspect is that you have to decide what type of investor or trader you are. Don’t switch around time to time. For example, don’t start off as a long term investor but panic and turn into a day trader. The psyche and skills required to succeed in each type are different. Likewise, don’t start off as a trader and now refuse to recognise losses and turn into a long term investor. Either way it is not going to turn out well. You have to choose who you want to be and stick to it.

Don’t give up. You can do it.